A month ago I announced I was selling my eCommerce site, TrollingMotors.net. In rather unorthodox form, I shared all of the financials, offered a 5% bribe/referral commission to get people to spread the word and structured the sale as a reverse auction.

It’s been a pretty exciting few weeks since the initial post, and I wanted to provide an update on the sale and how the process was received.

The Initial Reaction

One of my goals was to generate a lot of publicity around the sale (and for eCommerceFuel), and I’m not sure things could have gone much better in that regard.

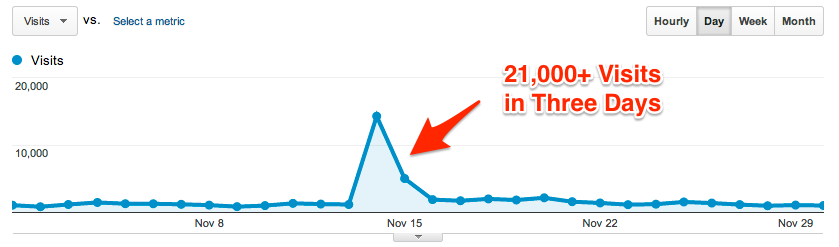

Within a few hours of publishing the post, it hit the front page of HackerNews, a Reddit-style site in the tech community. Traffic poured in, and at the peak there were more than 280 people reading the post at one time. Within three days, about 20,000 people read the article online.

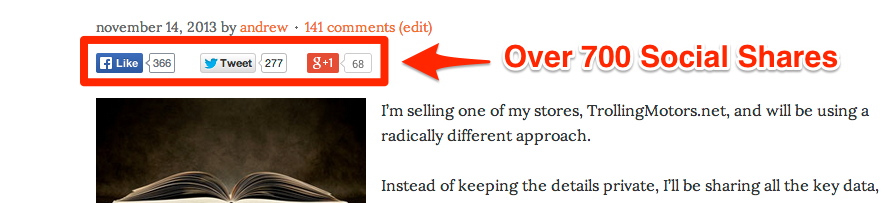

Apparently, the open-book nature of the sale plus the bribe was effective in spreading the word. The article received more than 700 social shares, which undoubtedly helped drive traffic and attention.

Reactions were overwhelmingly positive. Most people really enjoyed seeing the inner workings of not only an eCommerce site, but also the sale process. But there were a few less enthusiastic readers.

One business broker I spoke to seemed perplexed by my peculiar approach and was somewhat dismissive until I told him about the traffic and interest I was generating. Another broker offered some well-reasoned insights on why he would have structured things differently. I hope to be able to bring him on the podcast or blog in the future to discuss.

But by and large, I couldn’t have asked for a better kick off to the sales process.

The Bid

As I’ve mentioned, the sale was structured as a reverse auction (sometimes called a Dutch auction). The price started high (at $185,000) and was slated to drop by $10,000 at scheduled intervals until someone submitted a bid.

I also offered potential buyers a detailed prospectus with more information about the company and the bidding process, which they could download after signing a non-disclosure agreement (NDA). In the days after sale was announced, I had nearly 50 people submit NDAs requesting more information and a bid sheet.

While I felt I had priced the site on the upper end of fair-market value, I had no idea how long it would take to receive a bid. I structured the sale as a reverse auction because I thought it would create a sense of urgency and potential loss among bidders. But making a purchase of this size isn’t a trivial matter. Buyers still had to dive into the initial diligence information, think about the investment and get comfortable with the idea.

Although I thought the starting price was in the reasonable ballpark, I had also heard from people who didn’t think it was worth anywhere near the initial asking price. I thought — and still think — that was fairly off-base, but it still made me unsure of what would happen.

I received the first bid four days after the auction was announced and two days before the price dropped by $10,000. The bidder was someone from my email list (sorry commission hopefuls!) who had been following my work at eCommerceFuel. He was looking to get into the eCommerce market, and although he didn’t have any industry experience, he had a solid background in business. To top things off, he loved fishing.

Despite all the interest from potential buyers, no other bids came in at the $185,000 level by the deadline.

The Process

Shortly after the bid period ended, the bidder and I had signed a letter of intent to move forward with a sale. A letter of intent (often referred to as an LOI) is a non-binding agreement that expresses the good-faith intention of both parties to close a deal.

Although the agreement isn’t binding, the bidder put down a $5,000 earnest money deposit into escrow. It’s refundable if the transaction closes OR if the deal is called off due to misrepresentations I made about the company. But if the bidder changes his mind, it’s non-refundable.

With the LOI signed, we’re now in the diligence period before closing. The bidder is digging into the company’s sites and financials to ensure that everything I said was accurate and he’s not getting sold some fly-by-night scam. In the interim, I’m working to get things cleaned up on our side so that we can easily hand off an independent and well-organized business to the buyer.

The final step to closing the transaction is to sign an asset purchase agreement. This is the final, binding agreement that stipulates all the terms of the sale. We’re hoping to sign this agreement, hand over the business and close the transaction shortly after the new year for tax and accounting purposes.

I’m not sure I could have asked for a better buyer in terms of reasonableness, business experience and generally being great to work with – our working experience so far has been outstanding. Business sales are notorious for falling apart at the last minute, so I don’t want to get too excited, but I’m optimistic we’ll be able to finalize everything and close the deal in 2014.

Assuming everything closes successfully, I’d love to bring you an interview or blog post with both myself and the buyer to talk about the transaction, the process and our different perspectives on the deal. I think it would offer a unique view of the transaction from both parties’ perspective.

Would I Do It Again?

It’s still a little early to declare the experiment a sure-fire success, but I’ve been thrilled with how things have turned out so far.

I can’t imagine getting the same level of exposure for the sale with a traditional business broker, not to mention the saved broker fees. And the benefit to eCommerceFuel in terms of additional readers, links and exposure is easily in the thousands of dollars. While it’s impossible to know for sure, I believe leveraging the eCommerceFuel brand and transparency helped me get a premium price for the company.

I do have one potential hesitation. If I were to sell a business in the future that was significantly larger — say at the $500,000 price range or up — I’d consider this public approach more carefully.

At that price level, buyers would likely be established investors accustomed to a traditional sales approach and might be put off by the open, unorthodox nature of this process. Additionally, there wouldn’t be as many buyers for a larger site, so running a reverse auction where the price dropped over time would be riskier.

But for this particular business, I couldn’t be happier with the approach and the outcome.

Follow-Up Post: The deal closed, but not without a few bumps along the way. You can read my follow-up post titled How I Nearly Botched My Business Sale here.

Questions?

Happy to answer any questions you may have about the sale or the process! Just let me know in the comments below.

Photo by Oberazzi