Today I’ll be (hopefully) demystifying how to read a balance sheet, a potentially confusing beast for those unfamiliar with it.

First off, what is a balance sheet and what does a balance sheet show? At it’s simplest, a balance sheet shows what assets your company controls and who owns them. And if you’re concerned with not bankrupting your new store (“I TOLD you selling piranhas online would never work!”), it’s a pretty important statement to understand.

Fortunately, it’s not too difficult to grasp if you’re willing to learn a few key concepts. So let’s dive in!

Anatomy of a Balance Sheet

Unlike the income statement which shows how a company performed over a period of time, a balance sheet shows a business’ financial health at a single point in time. This will take the form of an exact date, like 9/30/2013 for example, and is usually prepared at a month or quarter’s end.

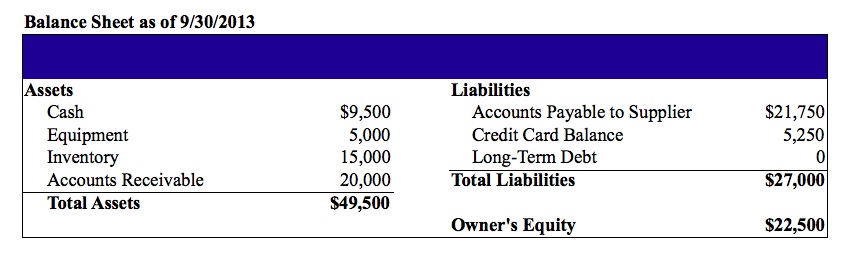

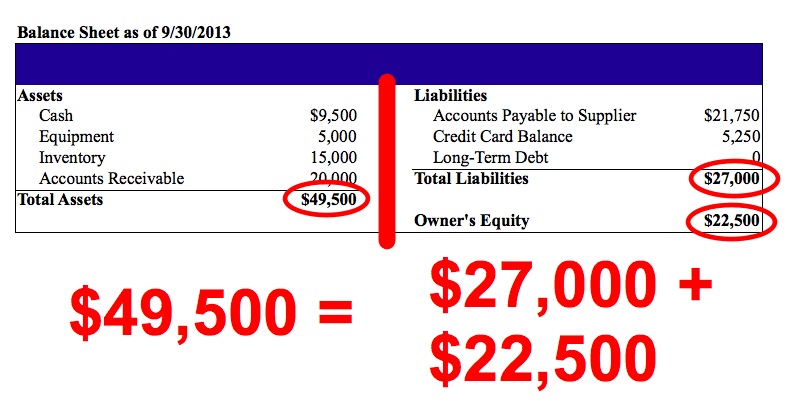

The balance sheet lets you know exactly what things of value a company controls (assets) and who owns those assets: someone else (liabilities) or the business owner (owner’s equity). Revisiting our friend Phil from last time, you can see the balance sheet for his business The Parachute Palace below:

Assets

An asset is anything of value your business controls, regardless of who owns it. Cash, office equipment (computers, chairs, etc) and inventory are all considered assets. So are accounts receivable, which represents people who owe you money but haven’t yet paid.

This is an important enough concept to repeat: the financial ownership doesn’t matter. If something is in possession of a company, it’s considered an asset.

Did your business manager go out and borrow $60,000 to 100% finance a new Escalade for sales calls? The car may be entirely owned by the bank (and causing Dave Ramsey to cry), but it’s still an asset as far as the balance sheet is concerned.

Liabilities

Liabilities are debts you owe to other people. This could be a credit card balance, payment owed to suppliers who offer you 30 or 60 day payment terms or long-term debt – like the loan on that new Escalade.

Any debts or future financial obligations you have to pay should be listed in the liabilities section.

Owner’s Equity

Owner’s equity represents the portion of the business assets that you own free and clear. Think of it this way: if you liquidated all of your assets and then paid off all the debts you owed, the amount left over would be your “owner’s equity”.

It’s important to understand that owner’s equity is NOT necessarily how much the business is worth in a sale. Because businesses usually sell based on a multiple of their earnings, the value of a business will usually (but not always) be greater than the owner’s equity value (also called “book value”).

The Balance Sheet Equation

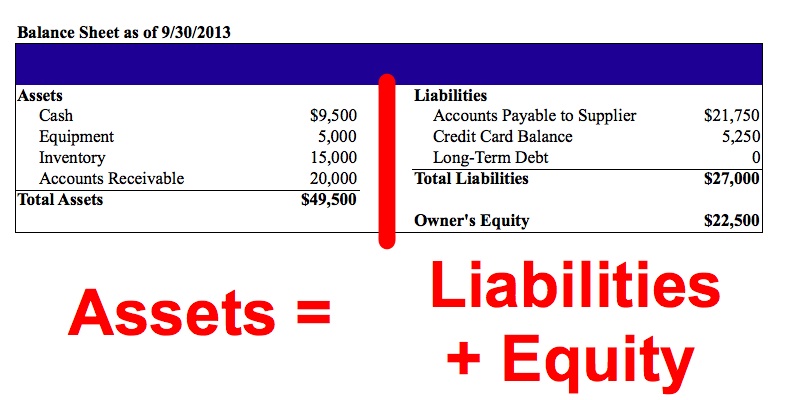

The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. The balance sheet is separated with assets on one side and liabilities and owner’s equity on the other.

This one unbreakable balance sheet formula is always, always true: Assets = Liabilities + Owner’s Equity.

In our balance sheet from above, you can see that this holds true:

At first, this rule can be really confusing. But think of it this way. All the assets owned by a business fall into one of two categories. They’re either owned by a creditor (you had to take a loan to get them) or they’re owned by you (you paid for them in full). That’s pretty much all the balance sheet equation is saying!

The Home Mortgage Example

Let’s use a simple balance sheet example that you’re probably familiar with – a home mortgage. Assume you recently purchased a home worth $250,000. With the financial carnage of 2008 fresh in your mind, you put down a healthy 20% down payment of $50,000 and took out a loan for the remainder of the balance of $200,000.

What would your balance sheet look like in terms of assets, owner’s equity and liabilities?

The asset column would be the value of the home, regardless of who owns it. So in this case, the value of the home is $250,000. Assets = $250,000. Our liabilities – the amount we owe to someone else – is the value of the loan. This is what we’re financially obligated to pay to someone else. So liabilities = $200,000.

Let’s go back to our universal balance sheet formula: Assets = Liabilities + Owner’s Equity

Inserting our values, we get:

$250,000 (Assets) = $200,000 (Liabilities) + Owner’s Equity

At this point, you can compute owner’s equity one of two ways. You can either do some simple algebra and solve for the equity figure. Or you can go back and recognize that we put down $50,000 of our own money. So that would be the portion of the home we own and which represents the owner’s equity.

$250,000 (Assets) = $200,000 (Liabilities) + $50,000 (Equity)

You’ve probably done this in your head before and never realized it was an accounting balance sheet at work!

And Then Come the Boars (Sorry, What?)

As I’ve mentioned repeatedly now, the rules of the accounting universe decree that a balance sheet ALWAYS must balance. So what happens a year down the road when some wild boar trainers and their 20 filthy animals move in next door and reduce the value of your property by $30,000? (A common occurrence, I’ve heard.)

Let’s tackle the asset side first. Because the market value of the home has gone down by $30,000, we’ll reduce the asset side by that amount – from $250K to $220K:

$220,000 (Assets) = $200,000 (Liabilities) + $50,000 (Equity)

But now we’re in trouble as our balance sheet equation doesn’t balance. We’ll need to adjust either liabilities or equity to get things right.

Disregarding the small amount you’ve paid off your loan, let’s assume it’s still $200,000 – so this part hasn’t changed. So we’ll need to adjust the equity portion to balance the equation:

$220,000 (Assets) = $200,000 (Liabilities) + Equity

Equity = $20,000, so…

$220,000 (Assets) = $200,000 (Liabilities) + $20,000 (Equity)

Ouch – a $30,000 direct hit to the equity you had in the house! If you think this simple balance sheet example may be a bit far fetched, perhaps we should do something that’s more business related and less boorish (Pun 100% intended. Please don’t stop reading).

Purchasing a Sweet New Ride

Unfortunately, business for Phil at the Parachute Palace isn’t going very well. He had a few quality control issues with the parachutes and people haven’t been buying because of it.

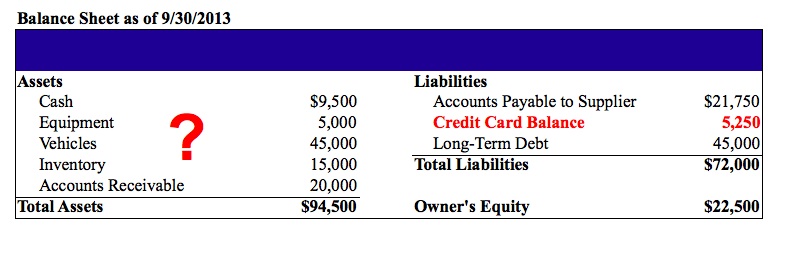

Improving the quality of the products would be too much work (obviously) so he hatches another plan. Instead, he decides to finance a brand new $45,000 BMW to make it look like his parachutes are selling like hotcakes and hopefully increase confidence in the business.

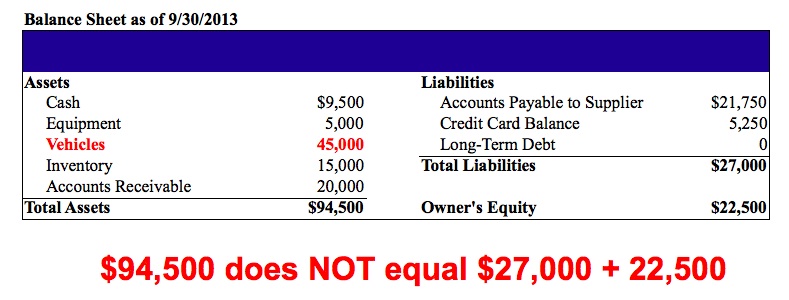

Let’s tackle the asset side of the accounting balance sheet first. Because the car is valued at $45,000, we’ll add this amount to the assets side under the account “Vehicles”. But this leaves our balance sheet unbalanced as you can see below:

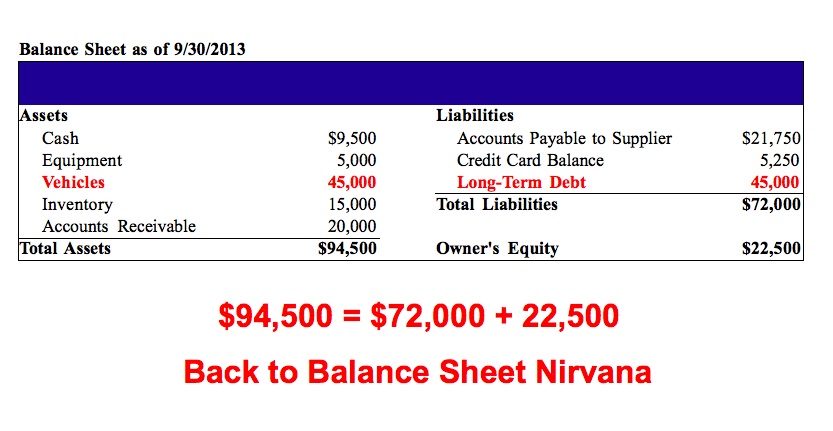

The way to fix it? We need to add the outstanding debt to the liabilities side, as seen below. Again, the assets of the business increase by $45,000 – but there’s no change in the amount of equity the business owner has. The entire amount was added to liabilities.

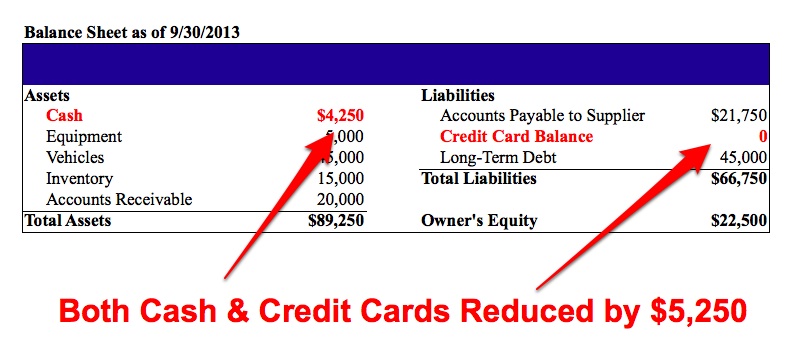

Let’s explore one more example. Realizing the error of his free spending ways, Phil resolves to start being more financially prudent and decides to pay off the business’ outstanding credit card debt, which is listed under liabilities.

For things to balance, we’ll need to make an adjustment to both sides of the balance sheet. Care to take a stab at which account on the asset side needs to be changed if he’ll be paying off the credit cards?

Notice that even though Phil’s cash levels decreased by over $5,000, the owner’s equity value of the business didn’t change. The payment simply decreased funds from the asset side (cash) to pay off a liability (the credit card) with no effect to the amount of equity Phil had in the business.

That’s the Basics….

There’s plenty more to the balance sheet, but I’ll spare you the gory details of shareholder distributions, accumulated deprecation and retained earnings that make accountants howl with delight. But using the concepts we covered, you should be able to make sense of most balance sheets you come across.

Have questions? I’d love to answer them! Just hit me up in the comments section below.