“Are you still interested in buying the business?”

The potential buyer had been grappling over the weekend with a few troubling issues he’d discovered in due diligence for TrollingMotors.net. It was now Monday morning, and we were on a stressful, high-stakes call to see if we could keep the deal moving forward.

On the line: losing a month of progress with a qualified buyer, and all the momentum I’d built with my public $185,000 auction process.

How did things get to this point?

The initial weeks of the diligence process went smoothly. Logistics for the transition were coming along nicely, we’d built a good working rapport and we’d even started training Clayton (the buyer) on our systems and products.

A week before we hoped to close the deal, I inadvertently hit Clayton with a one-two punch.

The first issues arose with Q4 revenues. Originally, I projected in my auction financials that I anticipated $105,000 in revenues for the last three months of the year. But the actual figure came in right around $85,000, about 20% less than I’d projected.

While not ideal, this alone probably wouldn’t have been cause for serious alarm. But there was one other thing …

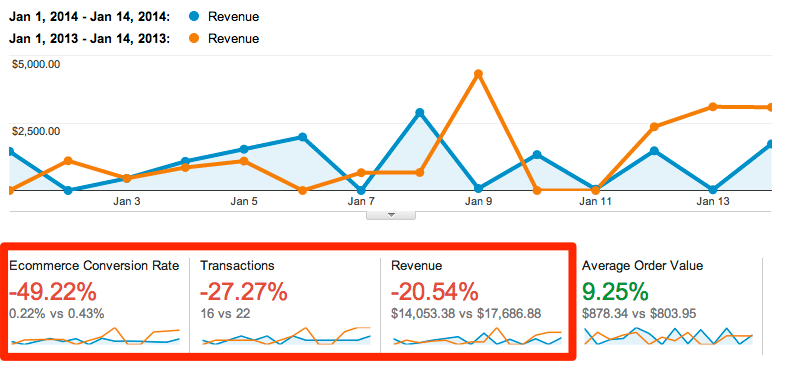

I received an email from Clayton a few days later asking if I had any ideas about why January 2014 revenues were down from 2013 levels. Digging into the analytics revealed a troubling picture, especially for a company supposedly experiencing strong growth: Year-over-year revenues for the first half of January were down 20%. Even more alarming, the conversion rate was 50% lower than it had been the previous year.

Not good.

The combination of a missed Q4 and a very weak start to 2014 made Clayton (justifiably) nervous. Was he getting ready to buy the eCommerce equivalent of the Titanic?

Fortunately, I was quickly able to come up with an explanation for the missed Q4 revenues. When the actual Q4 revenues were compared to previous years (as a percent of total revenues for the year), they were well in line with what would be expected in the highly seasonal fishing niche. I’d just been too cavalier with my estimates.

But the second scenario – the troubling start to 2014 and the gutting of conversion rates – was much harder to explain. Finally I figured out the problem: The previous January, we’d accidentally had our pricing set extremely low for the first 2-3 weeks of the year, which had artificially inflated our sales for a few weeks.

It wasn’t that this January was off to a bad start. Rather, last January had been extraordinarily good on the revenue side due to significant discounts we’d been offering.

I did my best to present data-backed explanations to Clayton, and I think for the most part he was convinced that they were legitimate. But with so much on the line, it was impossible to erase the doubts and hesitations that crept in. The fears of making an expensive mistake linger in the mind well after a logical explanation has been offered.

Clayton asked for the weekend to think things over, and I happily agreed. That brings us full circle to our Monday morning call …

“So, are you still interested in buying the business?”

After a weekend of rumination, Clayton decided he was still interested in moving forward. He still liked the company and believed in the underlying model/story. But he wanted to make one change.

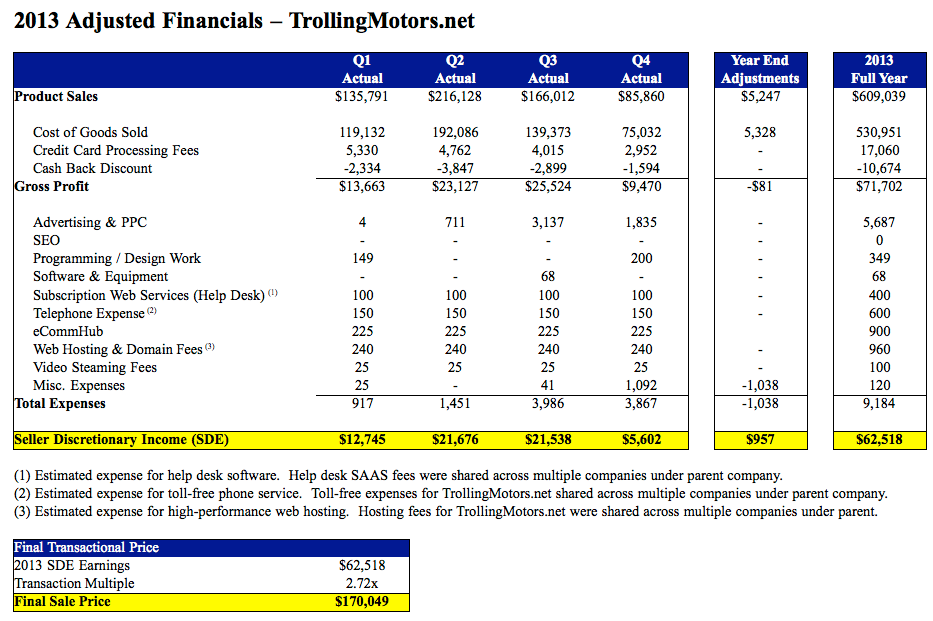

Instead of paying the initially agreed upon 2.84x multiple on 2013 earnings, he countered with a 2.69x multiple. His rationale was that he was still assuming more risk given the variances and had gone through a bit of a gut-wrenching process. Also, the business was growing at a slightly lower rate than what he’d believed when making a bid based on my estimations for Q4.

Given the scenarios I’d been contemplating (him walking away, a sub-2.0x offer, etc.), it was difficult to appear disappointed for negotiation’s sake. Anticipating a counter offer, I had written down the lowest multiple I’d be willing to accept prior to the call: 2.5x. So I felt like I could comfortably move forward at this level without any hard feelings.

I pushed back just a little bit on pricing, and we agreed to a 2.72x multiple. This put the new deal price at $170,049 when incorporating the new Q4 results. It wasn’t the original $185,000 I’d been planning on, but I was happy to have the deal back on track.

Four days later, with the wire transfer in my bank account and the deal officially closed, I was able to breathe a huge sigh of relief. So what did I learn from almost bungling my first business sale?

This goes for everything in life but is a great guideline for business: Set expectations conservatively and try to under-promise and over-deliver.

I was a complete dolt when setting revenue projections for Q4 2014. Instead of shooting for the lower end of the range to protect against downside and disappointment, I targeted the upper end of what I thought was reasonable in hopes of presenting the best company possible for the auction. Bad idea.

I also didn’t consider how much of the revenue from the year historically had come from Q4 in the past. If I had taken a few minutes to investigate this, I would have presented a more conservative picture and saved my buyer from expectation whiplash.

Getting bad news is never fun. But it’s usually much less detrimental if it’s proactively brought to you along with an explanation of why it occurred. As the recipient, you’ll usually appreciate the transparency and up-front behavior from the other party. It builds trust and lessens the impact, especially if a viable explanation is offered.

But discovering unnerving news on your own and having to probe for an explanation is unnerving. It makes you wonder what else is out there that you just haven’t found yet.

When I delivered the news of the Q4 miss to Clayton, I did a pretty poor job of explaining WHY the revenues missed. I didn’t do that until a few days later when I’d had a chance to think it through. I should have instead waited to deliver the disappointing numbers until I had a solid explanation to offer along with them.

Ditto on the slow start to 2014. I should have been tracking 2014 progress more closely, realized it seemed slower than the previous year, and reached out accordingly before Clayton had to bring it to me.

The longer a sale takes to close, the more likely something will pop up with the potential to derail the transaction. This goes double if you’ll be straddling the end of a financial period (like year-end in my case).

I had structured the deal so that the price would be based on the final 2013 numbers Overall, it took about two months from the bid date to close the transaction. In the future, I’d like to try to keep that to 30 days tops and price the deal based on past financials instead of relying on future results.

A strong working relationship built on rapport and mutual trust was one of the key factors that allowed us to close the deal. Without it, I’m not sure we would have been able to get through the rocky patch related to revenue misses.

So make sure you invest in any buy/sell relationship to inspire trust from the beginning. Get to know each other, follow through on what you say you’ll do and be honest. There’s a good chance you’ll need to lean on that credibility down the road if/when things get a bit hairy.

With the TrollingMotors.net sale officially closed, here are the final financials, adjustments and purchase price. The year-end adjustment columns includes a few adjustments for revenues/expenses that were booked in 2013 but didn’t hit the bank account until 2014 and needed to be added back in:

It’s been almost a month since we closed the transaction. After an inevitably crazy first week, Clayton’s settled in nicely and is getting comfortable running the business. You can check out his new About Us page, which has some pretty legit pictures from his own fishing adventures. The business is in great hands, and I wish him the best of luck going forward.

Have questions for myself or Clayton? He’s generously agreed to answer your questions in the comments below, and I’m happy as always to jump in as well. You can leave your questions / comments via the comment box below.