One of the perks of an eCommerce business is that you can often get started with very little upfront costs. But at some point, nearly everyone with a growing business has to consider financing. A monetary boost empowers you to invest in essential resources for your company, such as inventory, marketing, and technology.

Without adequate financing, your eCommerce business may struggle to compete or fail to reach its full potential. In this article, we will explore the basics of financing for eCommerce businesses, what financing options are on the table, and when you might use each of these financing options to help you grow.

TLDR for Financing

If you’re looking for the short and sweet answer there are some rules of thumb which will help:

- If you’re looking for a large loan and you have the time to go through the process look into an SBA loan or a loan from a local bank.

- If you’re looking for a large loan and you don’t have the time look into a merchant cash advance.

- If you’re looking for a smaller loan and you want good terms / rewards look into business credit cards.

When Is it Time to Pursue Financing Options?

Before you pursue financing, you should determine if it’s the right time for your company.

Seek Financing When Your Business Is Established

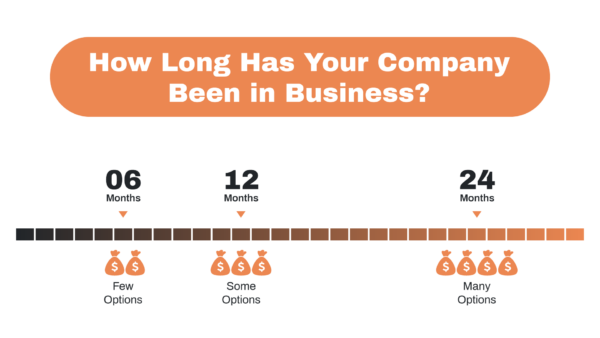

If you want to access capital, your business needs to be able to show growth and ideally profit. The longer your company has been operating and making money, the better. If your business is less than six months old, it will be tricky to secure financing. But if you’ve been operating for more than two years, you’ll have an easier time accessing multiple financing options for eCommerce businesses.

It’s better to have a mix of financing options available to you, as options can abruptly become unavailable or change significantly. For example, a bank that offers small business loans may go out of business, or a credit card company may change its terms and interest rates.

We had our [line of credit] pulled in September 2020 with zero notice […] Luckily, we were able to buy some time, get an SBA 7a loan to pay it off, and get away unscathed other than a lot of stress and wasted time.

-An ECF Forum member

Seek Financing When You Have Time To Pursue It

Financing is often a trade-off between the money you’ll get and the work it takes to secure it. Low-cost financing options, such as loans from traditional banks, require significant time and effort to secure, including detailed business plans, financial projections, and personal guarantees.

On the other hand, credit cards or merchant cash advances, may be easier to obtain but come with higher fees and interest rates. As a result, eCommerce businesses must weigh the costs and benefits of different financing options and choose the one that best fits their needs and goals.

Banks, Credit Unions, and SBA Loans

Local banks and credit unions are often the best option for low-cost and reliable financing. These institutions typically offer a range of financing options, including term loans, lines of credit, and access to Small Business Administration (SBA) loans.

While it may take some time to find a bank or credit union that understands the unique needs of an eCommerce business, the effort is usually worth it. Local banks and credit unions often have more flexible lending criteria and better terms than larger, national banks. They’re also more likely to work with eCommerce merchants to tailor a financing solution to their specific needs.

Banks and credit unions offer four common financing options for eCommerce merchants:

- Term Loans: The lender provides a lump sum of money that must be repaid over a fixed period of time, typically with fixed monthly payments.

- Line of Credit: The lender provides a maximum amount of money the borrower can access and use as needed. Interest is charged only on the amount borrowed.

- SBA Loan: The lender facilitates a loan provided by the Small Business Administration

- Asset-based lending: The lender uses the borrower’s assets, such as inventory or accounts receivable, as collateral to secure the loan.

Term Loan vs. Line of Credit

When deciding between a term loan and a line of credit, merchants should consider their specific needs and goals.

A term loan is a good option for merchants who need a specific amount of money to fund a specific project or purchase, such as moving to a new warehouse or buying new equipment. This type of financing provides a lump sum of money that must be repaid over a fixed period of time, typically with fixed monthly payments.

Some term loans from ECF members:

| Bank | Rate | Limit |

| Chase | Prime + 2-3% | 100k |

A line of credit is a good option for merchants who need ongoing access to funds to cover variable expenses or take advantage of opportunities as they arise. This type of financing provides a maximum amount of money that the borrower can access and use as needed.

Interest is only charged on the amount borrowed. If you don’t draw from the line of credit, then you won’t pay any interest, which is incredibly helpful when cash flow becomes tight.

The best time to get a bank LOC is when you don’t need it (seriously).

-An ECF Forum Member

Some lines of credit from ECF members:

| Bank | Rate | Limit |

| Bank of America | Prime + 4% | 500k |

| PNC Bank | Prime + 4.5% | 5M |

| Truist | Prime + 0.75% | 175k |

| Fifth Third | 3.26% | 500k |

SBA Loans

The Small Business Administration (SBA) offers several different types of loans:

- 7(A)

- CDC – 504

- CAP Lines

- Export Loans

- Microloans

- Disaster Loans

The 7(A) loan is the most popular option. It provides working capital of up to $5 million for businesses that have a decent credit score and can provide a down payment of 10-20%. It can be used for a variety of purposes, including purchasing equipment, refinancing debt, making improvements to a business, or buying a business.

The Community Development Corporation or CDC/504 loan is specifically designed to purchase owner-occupied real estate. The terms of this loan require the borrower to occupy at least 51% of the space for their business, and the loan is typically structured with the bank lending up to 50%, the community development corporation lending up to 40%, and the borrower providing the remaining 10% as a down payment.

The SBA CAP Line is a line of credit of up to $5 million that can be used in conjunction with a 7(A) or 504 loan. These lines of credit are useful for eCommerce merchants who need to finance seasonal working capital or purchase orders.

The SBA Export Loan is a loan of up to $5 million that is specifically designed to help American businesses export their products overseas. These loans have some of the best rates and terms available through the SBA.

The SBA Microloan is a small loan of up to $50,000, with the average loan being $13,000. These loans are designed to provide eCommerce merchants with access to capital for small-scale projects or purchases.

Finally, the SBA Disaster Loan is available to businesses in declared disaster areas to help them recover from the effects of the disaster.

Finding and Securing an SBA Loan

Not all banks process SBA loans. You can use the SBA’s lender reports website to find a list of banks that have made SBA loans in the past and start contacting them.

It is important to remember that the SBA loan process can be very time-consuming and require detailed documentation, so it is important to start early and be prepared. One ECF member said this:

At times, it felt like a 2nd job to get it done.

If you do get turned down for an SBA loan it means that specific bank didn’t want to take the risk. You can always apply again through another bank.

Some SBA loans from ECF members:

| Type of Loan | Rate | Limit |

| 504 | 2-3% | 810k for 25 years |

| 504 | 2.9% | 1.6M for 25 years |

Asset Based Lending

Asset-based lending is a type of financing that uses the assets of a business as collateral for a loan. With asset-based lending, the lender evaluates the value of a business’s assets (such as inventory, equipment, and accounts receivable) to determine the loan amount the business can qualify for.

With asset based lending your maximum amount of capital changes regularly along with your assets and accounts receivable. Some banks will require updates on your inventory every month. This type of lending is advantageous if you have a growing business, since the maximum amount of capital will grow with you.

Andrew interviewed David Golob about The World of Asset Based Lending on the podcast. Give it a listen if you want to learn more.

Some asset based lending loans from ECF members:

| Rate | Limit |

| Prime + 0.5% | 3.5M |

| 4% | 1.5M |

Credit Cards

A very polarizing financing option for eCommerce businesses are credit cards. They are convenient, flexible, and can usually be secured in a few days or weeks.

In addition to the financing benefits, many credit cards also offer rewards that can provide business owners with valuable perks, such as cash back and travel rewards.

Credit cards also give you an opportunity to delay payment using their grace period also known as the float.

Favorite Credit Cards from the ECommerce Fuel Community

There are a few credit cards the ECF community loves.

Chase Ink Business: 3x points for every purchase spent on travel and shipping

American Express Business Gold: 3x points on a single category of your choice. Enroll in FedEx open savings for 5% statement credits on FedEx charges

Capital One Spark Business: Easy instant approvals and flat 2% cash back on everything

Parker: No collateral, no personal guarantee, 60 day float

Some credit card rates from ECF members:

| Name | Rate | Limit |

| Bank of America Business Card | 13% APR | 70k |

| Chase Ink Preferred | 45k | |

| Capital One Spark Business | 65k |

Credit Card Rewards Wizardry

As someone who doesn’t play the credit card game I can only call it what it looks like to me: wizardry.

When you get good at maximizing credit cards you can get some serious rewards. One discussion on the ECF Forum was about combining the rewards from two Amex cards:

If you spend $50k a month on shipping and advertising on an Amex Gold Card, because of the 4x multiplier with the NEW gold cards that’s 200k points per month.

You can transfer Amex points to Schwab with [Amex Platinum Charles Schwab] card where each point is turned into $0.0125. From your Schwab account you can obviously cash this out or use it to invest.

If I spend $50k to get 200k points and I transfer those points into Schwab, I get $2500 (200,000 x .0125). $2500 / $50,000 is 5%. So, essentially, I’m getting a 5% cash rebate on my shipping and advertising spend.

Without this wizardry you could get a 2% cash back return with the Capital One Spark Business card. But by using a little savvy and planning you can get a 5% cash back return. When you’re spending tens of thousands on shipping and advertising that can be a huge difference.

Business Credit Card Protections

It is important for business owners to be aware that business credit cards are not protected by the Credit Card Act. The Credit Card Act is a federal law that provides protections to consumers. These protections do not apply to business credit cards so buyer beware.

Low Credit Score / New Business Options

ECommerce business owners with low credit scores or very new companies may have difficulty accessing traditional forms of financing, like bank loans. So let’s explore the alternative financing options for these kinds of eCommerce businesses.

Crowdfunding

Crowdfunding platforms, like Kickstarter or Indiegogo allow businesses to raise funds from a large number of individual investors. This is a great option if you have a new product that you want to release. You can secure the funding upfront to make products for exactly the people who want them.

Business Grants

Grants are monetary awards from private organizations or government entities. They don’t come with financial strings – which means you won’t have to pay interest.

However, the application process can be lengthy and very competitive. You will also have to do a significant amount of research to find grants your specific business type is qualified for.

But there are certainly grant options for eCommerce business. For example, the Business Development Bank of Canada is giving $15,000 to digitize your business. And you also get access to a $100,000 loan with 0% interest. This could be a major boon if your business meets all of the criteria.

Merchant Cash Advances & Revenue Based Financing

Merchant cash advances provide businesses a lump sum of cash in exchange for a percentage of future sales. This can be a good option for eCommerce businesses that have a steady stream of incoming sales and need access to cash quickly.

Once you start making sales, platforms like Amazon, PayPal, Shopify, or Wayflyer make it easy to request funding to grow your business. However, these fees are structured differently from the traditional annual percentage rate (APR) you get from a credit card or bank loan.

If you’re not careful, merchant cash advances can eat up a significant amount of your profits.

One ECF forum user posted about their experience with a merchant cash advance:

We have an outstanding loan with Wayflyer now. We think they’re fairly decent. Not as cheap as a bank, but we’re paying close to 20% interest when adjusted for APR.

A frequent guest on the ECF Podcast, Bill D’Alessandro, shared a calculator that shows how a 9% fixed-fee loan turns out to be a 44% APR.

And here is another user’s honest opinion of their merchant cash advance:

The money was needed, I was grateful it was available, but holy crap the interest just about ate us alive and kept us in the cash crunch way longer than we needed to be in it.

Try to finance your company’s growth with traditional financing options. But if you’re still short and need cash flow to maintain momentum, then a merchant cash advance might be your best option.

Online Lending

It is worth mentioning that some online banks sit between a merchant cash advance and a term loan from a local brick and mortar bank. Two such examples are On Deck and Kabbage.

The fees are complex and difficult to compare against a traditional APR rate. But generally they’re easier to secure than a term loan from a bank and less expensive than a merchant cash advance.

Final Thoughts on Financing Your Business

You want a growing, thriving eCommerce business. But growth often comes with an increased need for cash. Whether you’re investing in a lengthy application and review process for low interest rates, or opting for fast cash with higher interest rates, make sure you make the best choice for your company’s needs – and keep growing!

If you want more tips and resources to help grow your eCommerce business, join our community of 7-8-figure brand owners. All our members are vetted practitioners – not vendors or beginners – ensuring everyone has a deep, meaningful eCommerce experience to share. Sound interesting? Apply for membership and join us today.