Alphabet has agreed to acquire Intersect in a cash transaction valued at $4.75 billion, including the assumption of debt, in a move that underscores the growing interdependence between data center expansion and energy infrastructure development in the United States.

The deal builds on an existing relationship between the companies, as Google already holds a minority stake in Intersect from an earlier funding round.

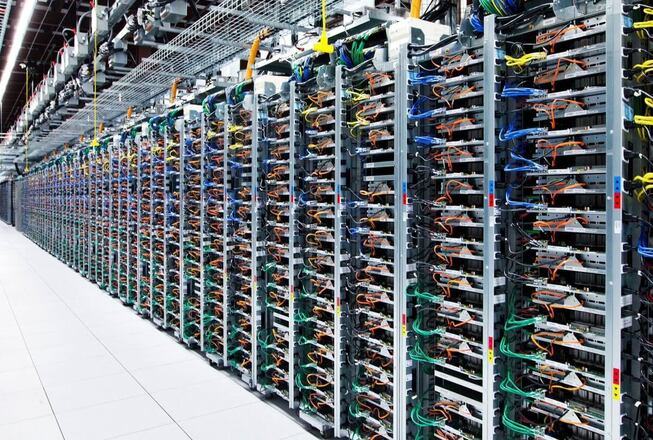

The acquisition is designed to accelerate the delivery of new data center capacity alongside new power generation, addressing one of the most pressing constraints facing the cloud and AI infrastructure market: access to reliable, scalable energy. Intersect brings with it a portfolio of multiple gigawatts of energy and data center projects that are either under development or already under construction, many of them tied to its longstanding partnership with Google.

Under the terms of the agreement, Intersect will continue to operate as a separate business under its existing brand, led by founder and CEO Sheldon Kimber. The company will work closely with Google’s technical infrastructure teams on both ongoing and future projects. Among the most visible of these is a co-located data center and power generation site currently under construction in Haskell County, Texas, which has been highlighted as a model for tightly integrated infrastructure development.

Not all of Intersect’s assets are included in the transaction. Its operating facilities in Texas, along with operating and in-development projects in California, will remain outside the scope of the acquisition and continue to function as an independent business. Those assets are backed by existing investors including TPG Rise Climate, Climate Adaptive Infrastructure, and Greenbelt Capital Partners, with the companies indicating that customers should expect continuity of service.

Rising Cloud and AI Demand

Alphabet and Google have positioned the deal as part of a broader strategy to expand U.S. energy supply in parallel with surging demand from cloud computing and AI workloads. Rather than relying solely on existing grid capacity, the company has emphasized partnerships with utilities and developers to bring new generation online without shifting costs to other grid users. Intersect is expected to play a central role in that effort by coordinating power development directly with data center load growth.

Beyond traditional energy sources, Alphabet has indicated that Intersect will explore emerging technologies aimed at diversifying supply. These include advanced geothermal systems, long-duration energy storage, and gas generation paired with carbon capture and storage. Alphabet has also pointed to the use of AI tools to streamline grid interconnection processes and improve energy efficiency programs in communities hosting large-scale data centers.

The transaction reflects a broader trend in which hyperscale technology companies are taking a more active role in energy development, driven by the scale and density of AI workloads. By aligning power generation more closely with infrastructure deployment, companies aim to reduce delays, manage costs, and improve long-term sustainability.

The acquisition is subject to customary regulatory approvals and closing conditions, with completion expected in the first half of 2026.

Executive Insights FAQ

Why is Alphabet acquiring an energy-focused infrastructure company?

The deal supports faster, more coordinated deployment of data centers and power generation amid rising AI and cloud demand.

Will Intersect be fully integrated into Google’s operations?

No. Intersect will remain a separate company under its existing brand and leadership.

Which Intersect assets are excluded from the transaction?

Operating assets in Texas and operating and in-development assets in California remain independent.

How does this acquisition affect U.S. energy markets?

It reflects increased private-sector investment in new generation capacity tied directly to digital infrastructure growth.

When is the deal expected to close?

The companies anticipate closing in the first half of 2026, subject to standard conditions.