No one is excited about taxes. But tax season is especially grueling for eCommerce business owners — inscrutable sales tax compliance rules, detailed inventory tracking, reconciling bank statements against deposits — it can be a convoluted mess. If you were working a regular job, this wouldn’t be your problem. However, when you chose to run your own business, you took control your own destiny…and your tax bill.

You’re a boss! An entrepreneur! You can handle your taxes. And I’m here to guide you toward the eCommerce tax strategies that will minimize what you owe and keep more of those funds to fuel your company’s growth.

Below, I’ll cover:

- Tax-efficient inventory and investment strategies

- How to pay yourself as efficiently as possible

- Pro-level strategies that can save you big at tax time

Inventory and Capital Investment Tax Strategy

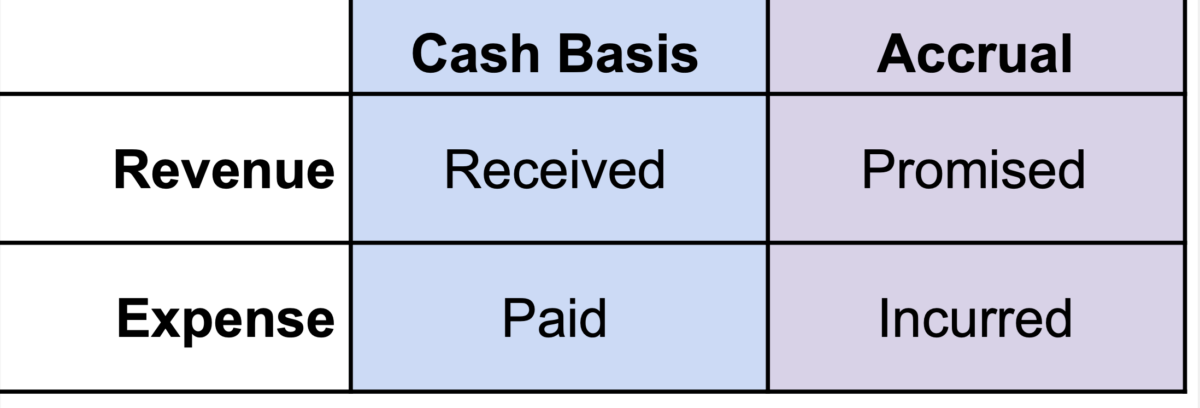

When many eCommerce companies first start, they use cash-basis accounting. With cash-based accounting, expenses are booked when they hit your bank account, and so is income. It’s easy to understand, which is why many companies start accounting in this fashion.

Cash accounting does allow for some easy tax savings. As an example, if you’re approaching the end of your fiscal year and it looks like you’ll have $50,000 in taxable income, you can choose to purchase $50,000 worth of inventory or equipment and thereby eliminate the taxable income in that fiscal year. However cash accounting does a poor job showing how your business is performing.

As eCommerce businesses grow, it is strongly recommended that they switch to accrual accounting. When you purchase $50,000 of inventory under accrual accounting, you actually don’t have an expense because that transaction converted cash into inventory, simply moving values around on your balance sheet. The inventory costs are only deductible when the inventory is sold. Revenue is booked when the transaction is made on your site or when you send an invoice to a customer, not when you actually receive the funds. If you make a capital investment, say into a new piece of machinery, the investment has to be amortized over the expected lifetime of the equipment. So a $100,000 investment might actually be expensed at $10,000 per year over 10 years.

Accrual accounting, therefore, evens out the swings you would see under a cash-basis model and there are ways to optimize and save money on your taxes with accrual accounting.

Section 179

Under the Section 179 rule, a business can elect to deduct the full value of a capital expenditure (machinery, furniture and fixtures, buildings, etc.) in the first year it was put into service. Under this rule, you can offset up to $1 million in taxable income with a capital investment, which could be include machinery, computers, equipment, tooling. See below for a comparison chart of a $100,000 capital investment under straight-line accrual versus Section 179.

Note that there are now deduction caps for vehicles under Section 179; roughly $10,000 for a car or small SUV and $26,000 for a large SUV. And while we can no longer deduct the full price of a Tesla Model X, in our forums there was a long debate over the wisdom of deducting a six-figure Tiffany lamp!

Write-Offs

If you purchased $50,000 worth of inventory three years ago, and you still have $30,000 left, you’ve only captured $20,000 worth of expenses. But you can choose to write off the remaining inventory, resulting in a $30,000 deduction against your income. Note that when you write off inventory you actually do have to destroy it or donate it, and you should keep records to prove you actually did this. You can also write down the inventory, recognizing that it still has some value, but taking an immediate expense on the value it has lost. As you’re approaching the end of your tax year under accrual accounting, it’s always a good idea to look around your facility to see if any dead-stock inventory can be harvested for write-offs. There are even states that will give you a double-deduction if you donate goods to charity.

Payroll Tax Strategy

Your single biggest expense on your P&L is likely payroll, and it offers the largest opportunity for tax savings. When it comes to paying yourself you have three options, each of which is associated with a separate corporate structure: LLC, S Corp, or C Corp.

LLC Taxation

An LLC is the simplest entity, and any profits at year-end will pass through to the owners of the company as income on their personal returns. So, for instance, if your company had $100,00 in profit and you own 60% of the company, $60,000 will be reported as income on your personal tax return.

Unless you paid yourself via a W2, you will pay not just income tax on that $60,000 but also another roughly 15% in FICA taxes (Social Security and Medicare). This is the so-called “self-employment tax,” because it appears as if you’re paying double the FICA taxes compared to those with a “normal” job. But you’re simply paying both the employer and the employee rate of approximately 7.5%; most people with a W2 job only see the employee share.

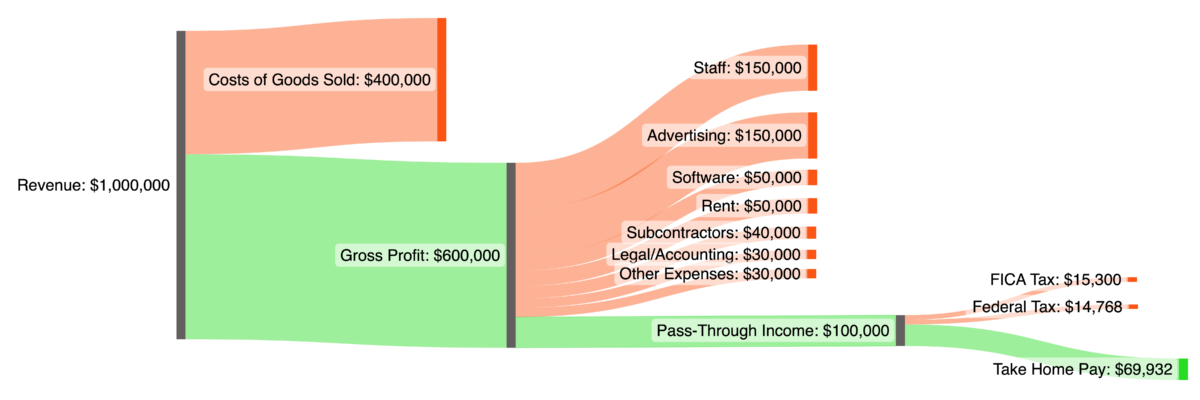

Here is a simple flow diagram showing a simple eCommerce business with $1 million in revenue, 40% COGS, and $100,000 in profit passed through to the single-filer owner after other expense items:

S Corporation Taxation

To avoid the dreaded double-FICA tax, many eCommerce owners implement S Corp taxation. Under this structure, the profit at year end also passes through to owners according to their ownership stakes, but in this case the funds are distributed as a dividend, free from FICA taxation.

The catch is that if you’re an active owner of the business (and you almost certainly are), you must also pay yourself a “reasonable” W2 wage, which is subject to FICA taxes. What’s left over after that wage would be the FICA-free dividend.

Here is that same chart as above, set up as an S Corp that pays the owner an $80,000 wage and a $20,000 dividend:

C Corporation Taxation

A C corporation structure is like an S corporation in that you’re required to pay yourself a W2 wage, and the remaining profit would be a dividend. However, a C corporation can elect to retain earnings, and not pass along the dividend to the owners of the company.

If a dividend is issued, it would be taxed at the personal level as capital gains, not income, and thus taxed at a lower rate. The catch, and there always is one, is that the dividend is first taxed at the corporate level at 21%, and then taxed at the personal level as a capital gain at a rate from 15% to 20%. With the double taxation the final tax bite could end up similar to the income tax rate that is applied to an S corp dividend, although it really depends on your marginal tax rate. The federal capital gains tax is only 15% on dual filers all the way u

p to $517,200 in income, whereas the income tax rate is over 30% above $340,000 in income.

So a C corporation dividend could put you ahead at higher income levels, at least when it comes to federal taxes. Many states tax capital gains at the same rates as income, but some tax it at lower rates and a few don’t tax capital gains at all.

Here is the simple eCommerce tax chart from above, with the same assumptions although this time set up as a C Corp:

Retirement Accounts

Whichever corporate structure you choose, though, you can shield your income from immediate taxation by placing it into a retirement plan. A 401k, SEP IRA, or defined contribution plan run through your business payroll will be a deductible expense at the company level, and then pass tax-free to you at the personal level.

Company-sponsored retirement plans offer a much higher total contribution limit ($66,000) than IRA plans ($6,500), so setting them up is well worth the small administrative costs. Retirement plans must be offered on largely the same basis to all employees, though, so if you’re generous with a company match to your own retirement account you must also be generous to that of your employees.

Your ability to make employer contributions to your own plan can also be capped by the participation rate of your employees. But for a small, closely-held company, retirement packages can function to pass tens of thousands of dollars tax-free into personal retirement accounts. Just remember that although funds aren’t taxed going into retirement accounts, they will be taxed when they’re withdrawn from the account. Uncle Sam gets his in the end, always. But your tax bracket might be smaller in retirement than right now.

Other Pre-Tax Accounts

Beyond retirement, health savings accounts (HSAs), flexible spending accounts (FSAs), and dependent care flexible spending accounts (DCFSAs) offer additional ways to incur tax-reducing deductions at the company level and tax-free income at the personal level.

If you offer company-sponsored high-deductible healthcare plans (and these days most plans are high-deductible), employees are allowed to put $3,850 per year into an HSA, and twice that for a family plan. These funds are not taxed, and can be used to pay for any medical expenses. The funds are yours forever, and do not need to be spent by the end of the year.

Even better, once you’ve reached a certain threshold of savings, you can actually invest the funds so that the account can grow over time. If you don’t offer high-deductible plans, you are limited to an FSA plans. These are also funded tax-free and can be used to pay for any medical expenses, although the limit is smaller at $3050 and the funds must be spent before the end of the year. If they are not spent, they are forfeited, although due to recent changes in the law up to 20% can be rolled over into the following tax year.

Similar rules apply to DCFSA plans, which work like FSA plans but for dependent childcare. The DCFSA limit is $5000 per household, the funds can be used to pay for preschool, childcare, summer programs, tutoring, etc., and the funds must be spent in that year with a three-month grace period.

Here are the 2023 contribution limits for these plans:

Home Office Deduction

Most taxpayers are familiar with the home office deduction, although it was largely eliminated with the 2018 tax law changes. However, you can still also reimburse employees (and yourself) via payroll with non-taxable funds for a home office.

The space must be used exclusively for work, and you can calculate the percentage of your home that the space represents, and then multiply that by your total annual home costs (rent/mortgage, property taxes, utilities, upkeep, etc.) to arrive at the reimbursement figure.

The reimbursements are deductible at the company level as an expense, and are tax-free at the personal level. Note that you must have an “accountable plan” to make sure that you are actually reimbursing employees for a legitimate home office, but the rule allows you to give tax-free dollars back to yourself and your team.

Adding Your Children to Payroll

The next payroll trick is often overlooked, but for business owners with children it provides that rare opportunity for your kids to actually save you money.

Minors pay zero federal tax on their first $12,950 of taxable income, so by putting your children on payroll you distribute up to that amount tax-free. Even better, you can pay them more than that amount and have the excess all put into a retirement account. Growing at 8% a year, $10,000 put into a retirement account at age fifteen would be $469,016 at age 65.

It’s a great way to set up your kids financially. There are some rules, of course. Your children must actually perform work for your company, and they must be of legal age to work in your state. Your children won’t even have to file a federal return if they earn under the threshold, although they might want to because they could be entitled to a refund on FICA taxes. Many states, though, have a filing threshold underneath the federal line, so you might have to file a state return for your child.

Advanced eCommerce Tax Strategies

Beyond accounting strategies, corporate structure, and payroll, there are a few additional wrinkles in the tax code that can benefit many eCommerce store owners.

The Qualified Business Income Deduction

The qualified business income deduction (QBI) was put in place during the 2018 tax law changes, and allows business owners to take a deduction of up to 20% of their W2 wage. For many eCommerce businesses grossing over $1 million, this will be the single largest source of tax savings for owners.

Income limits of $182,1000 for single filers and $364,200 for joint filers apply, although over that limit you might be eligible for a partial credit. Importantly, this deduction can be taken in addition to the standard deduction. If you have $125,000 of W2 income from your eCommerce business, and your spouse has $75,000 of income, you can shield a total of $52,700 ($27,700 standard deduction in 2023 plus 20% of $125,000) from federal taxes. Not bad!

Even above the income limits, though, you can get a partial QBI credit, and as discussed in a long thread in our forums it makes sense to take roughly 28% of your income on a W2 basis when you’re above the QBI income threshold.

The R&D Credit

The R&D Tax Credit is one of the most generous federal tax credits, and it can actually wipe away a portion of your tax bill. If your company develops products, procedures, processes, or software in a way that utilizes experimentation, you may be able to recover a portion of the payroll expenses allocated to that research and development.

Simply bringing a product to market likely doesn’t qualify, as there must be hard science utilized in the process. But if you employ engineers or programmers, or have a manufacturing component to your business, you might be eligible.

The best way to claim the credit is to work with companies that specialize in qualifying businesses for it; these companies will extensively document why you’re eligible, and argue with the IRS on your behalf if needed, in exchange for a percenta

ge of the credit.

The Augusta Rule

The Augusta Rule was allegedly created to benefit owners of homes in Augusta, Georgia who annually rented out their homes to golf fans in town for the Masters Tournament. It allows you to rent out your home for up to 14 days tax-free per year, so long as the home is your principal residence. For eCommerce owners, this is an opportunity to rent your home to your company and incur a deductible expense at the company level and tax-free income at the personal level.

To comply with the law, you should document and invoice your company for the usage, whether for a company retreat or meeting, or a product shoot, or temporary storage of inventory.

Return of the SALT Refund

One of the largest changes in the 2018 tax law was the capping of so-called state-and-local-tax aka SALT deductions at $10,000.

Prior to this change, you could deduct all of your SALT from your federal taxes. For eCommerce owners who live in states with high tax rates this was a big sting; residents of California, New York, New Jersey, and other states had gotten used to a nice federal refund at tax time due to their large SALT bills.

States have been working to get around this limitation for their citizens, though, and “SALT pass-through workarounds” or “pass-through entity taxes” have been adopted in many states and were recently blessed by the IRS as legit. Many states have implemented these (see table below), and they vary by locality, but the idea is that the pass-through entity (LLC or S Corp) can elect to pay the personal taxes of its owners through the corporation itself.

This thereby reduces the income of the corporation, meaning less taxable pass-through income for the owners and no state income tax bill. In most states, though, you must set this up during the tax year, not when you file your tax returns. So if you’re in one of these states this would be a great time to set this up for 2023.

Qualified Small Business Tax Exclusion

If your business is a C corporation, the QSBS can potentially save you a massive amount of taxes if and when you sell your business. It allows shareholders in the corporation to pay zero federal capital gains taxes when the company is sold.

There are many restrictions, notably that you must own the shares for at least five years, that you must have been issued the shares when the company was first incorporated, that the corporation does not have more than $50 million in assets, the corporation must generally sells goods, not services, and that at least 80% of the assets of the corporation must be used in the main operation of the business.

If you can pull it off, the upside to zero federal taxes on the sale of your business is tremendous. The final hurdle, though, might be the most difficult: the tax exemption only applies to the sale of the stock of a business, not the assets of a business. The vast majority of eCommerce sales are asset sales.

An acquirer will generally prefer to acquire your intellectual property, your inventory, and your website and other selling channels, but not the whole corporation, as there could be unknown liabilities associated with the corporation, such an undeclared debts, pending litigation, etc. But if you qualify for the QSBS it is well worth seeing what the sale price difference would be for a stock sale versus an asset sale

Final Thoughts: eCommerce Tax Strategies

With the right attitude, tax season does not have to be daunting for eCommerce owners. From structuring your company the right way to taking advantages of programs like Section 179 and the August Rule, there is wide latitude to maximize your take-home.

Of course, while you should do everything possible to minimize your tax burden, please consult with an accountant or tax lawyer before implementing any of these strategies.

Want More? Access 200+ Tax Discussions Inside ECF

We only scratched the surface on financing, business structure, and setting up your business for success. There are over 200 in-depth discussions in the forum solely about taxes. If you want more resources to minimize your taxes and grow your eCommerce business, join our community of 7-8-figure brand owners. All our members are vetted practitioners – not vendors or beginners – ensuring everyone has a deep, meaningful eCommerce experience to share.