Getting a jumpstart on the holiday season will lead to more sales, fewer customer problems, and less cart abandonment — no matter how much you want to pretend it’s still summer.

So let’s take a look at some steps that you can take to improve your checkout process ahead of the holidays, and how Amazon Pay can help along the way.

Abandoned shopping carts mean lost customers and lost sales. And with the global cart abandonment rate at 79.19%,1 it’s time for your business to make solving this problem a priority — especially during the busy holiday season.

While there are a lot of reasons people may leave your store without making a purchase, a time-consuming checkout process sits at the top of the list. Customers expect a shopping experience that’s fast, easy, and secure. Let’s take a look at some data.

Insights from Baymard Institute

In 2022, the Baymard Institute, an independent research firm focused on ecommerce usability, conducted a study on shopper experience optimizations. Commissioned by Amazon Pay, the findings revealed some interesting insights about how shoppers approach online checkout.

The researchers observed that ecommerce shoppers often view their name as a single, unified entity. In fact, 42% of test subjects initially typed their full name into the “First Name” field, only realizing their mistake when they noticed the separate “Middle” and “Last Name” fields. This seemingly small error added unnecessary friction to the checkout process, as shoppers had to backtrack to correct the information.

The problem is even more pronounced on mobile, where shoppers may have to completely re-enter, delete, or copy and paste their name to get it into the right fields.

The Baymard Institute’s recommendation is straightforward — use a single “Full Name” field instead. This simplifies the checkout flow and avoids tripping up shoppers with overly-granular requirements.

Titles, suffixes, and other optional form elements can also make checkout appear more complex. So, reduce the number of fields, along with their complexity, as much as possible. If you don’t need a piece of information, remove it.

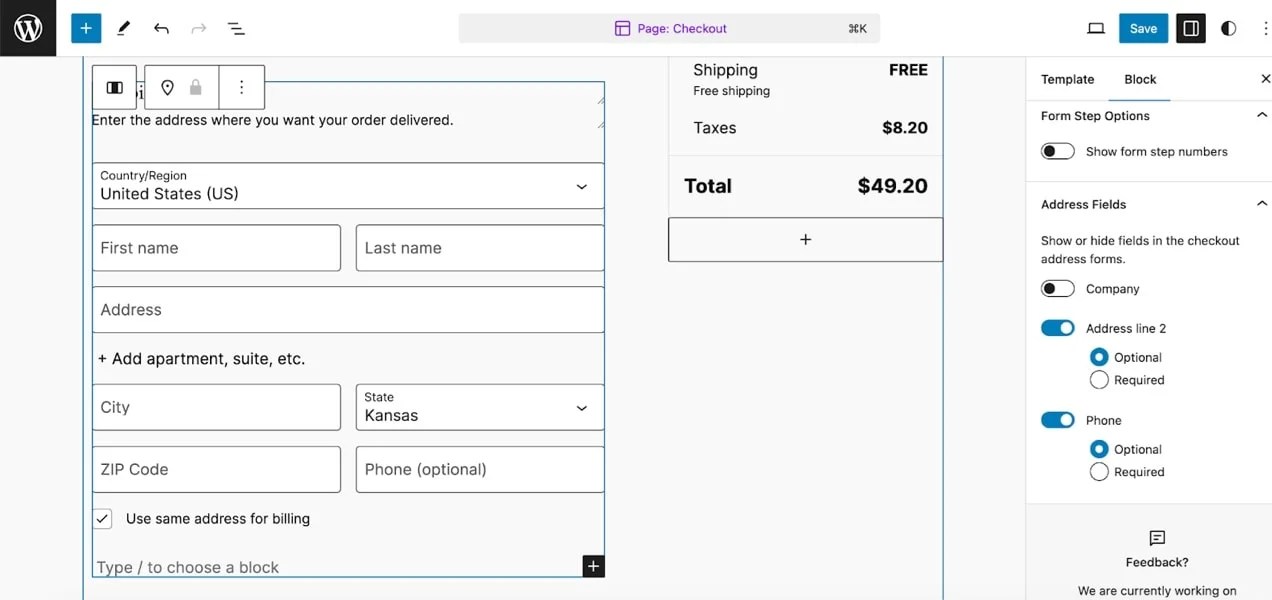

If you’re using a block theme, you can edit checkout fields with the Site Editor. Navigate to Appearance → Editor. Then, go to Template → WooCommerce → Page: Checkout. There, you can select the block you want to edit (e.g. The Shipping Address block) and quickly toggle fields on and off.

You can also use extensions like Checkout Field Editor for WooCommerce to remove, edit, and add any fields that you’d like.

Experienced with code or working with a developer? Learn how to edit WooCommerce checkout fields manually.

Take the time to go through your checkout process and test it across a variety of scenarios. For example, what happens if someone fills out a field incorrectly? Let’s say they enter an incorrect email address. Are they notified? Is the problem clearly explained? Or do they have to navigate backwards, figure out what they entered incorrectly, and even re-enter all of their information?

Test the checkout flow across all devices, too. How quickly can someone navigate through the process on a mobile device?

One of the best ways to streamline things is to use a payment gateway that keeps your customers on site to pay. For example, Amazon Pay is designed to work seamlessly on mobile devices, providing a smooth and efficient checkout experience for those shopping on smartphones and tablets. And since shoppers can use account and payment information from Amazon, they don’t have to worry about entering it all again.

Identifying and rectifying these types of bottlenecks can greatly streamline the checkout flow.

Creating an account slows down the checkout process. And while it may seem tempting to remove account functionality altogether, the better choice is to make it optional.

After all, there are plenty of reasons customers may want to create accounts — to track their order, to save credit card information or shipping addresses, to earn loyalty points and rewards, etc.

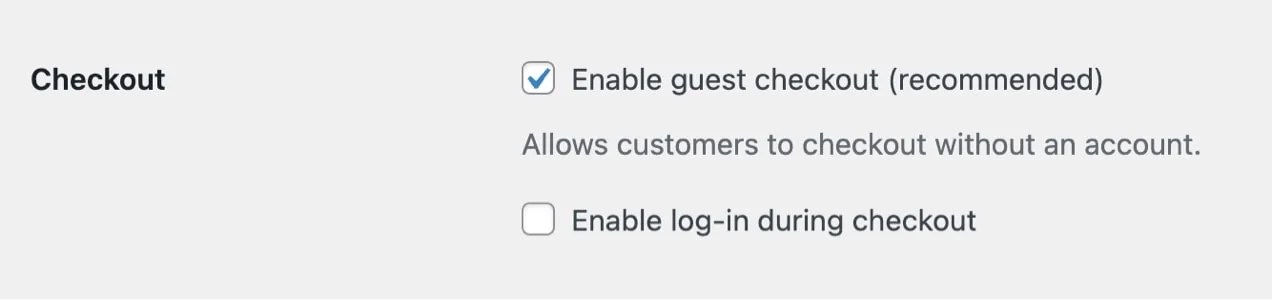

In your WordPress dashboard, go to WooCommerce → Settings. Click the Accounts & Privacy tab at the top. Then, select Enable guest checkout.

Want to take things a step further? Amazon Pay allows customers to use existing Amazon account information — such as credit card data and shipping addresses — so they don’t have to create an account or hunt down their credit card.

The faster you get your customer through the checkout flow, the less likely they are to abandon their cart. By making your checkout experience fast, easy, and secure, you reduce the time to purchase and increase the chance that shoppers will complete their orders.

Nine percent1 of shoppers abandoned checkout in the past three months because the site didn’t offer their desired payment option.

Alternative payment methods cater to a variety of customers, leading to a smooth and hassle-free payment process, a positive impression, and repeat business. Plus, it enables companies to appeal to customers globally, expanding their reach and customer base.

Diversifying payment methods can also mitigate risks associated with payment processing. Relying solely on credit card payments may expose businesses to the risk of chargebacks or fraud. Offering alternative methods spreads out this risk and provides additional layers of security.

Amazon Pay supports multiple currencies and languages, making it easier for merchants to sell internationally without worrying about complex currency conversions and translations. Plus, it boasts over 300 million4 active Amazon shoppers globally.

By adding Amazon Pay to your site, you can offer a recognizable payment solution and provide financing options that allow customers to complete larger purchases — such as buy now, pay later (e.g. Affirm), payment installments, and more — with little to no technical lift.

Sending follow-up emails to people who abandon their shopping carts is an essential part of an effective ecommerce strategy, helping you recover sales, engage customers, and build long-term relationships.

Many shoppers abandon their carts due to distractions, unexpected shipping costs, or indecision. Follow-up emails target those who have already shown interest in your products, making it a more financially-sound and effective marketing strategy than getting your products in front of people who are unfamiliar with your brand.

You can use tools like Mailchimp and AutomateWoo to quickly design branded, effective emails and send them automatically when someone abandons their cart. Add incentives to the emails, like free shipping or coupon codes.

And even if shoppers don’t complete their purchase immediately, they might return later or explore other items.

Amazon Pay’s streamlined checkout experience addresses many of the friction points identified above. By allowing shoppers to check out in as few as three clicks using the information already stored in their Amazon account, Amazon Pay can significantly reduce the time and steps required to complete a purchase.

This reduced friction translates directly to improved sales. Studies show that Amazon Pay can drive up to 35% higher conversion rates2 compared to standard merchant checkout flows.

In addition, Amazon Pay offers a secure checkout experience backed by Amazon’s innovative technology and risk management services — and 86%3 of Amazon Pay users conveyed their trust in the payment process.

By optimizing the checkout flow and tapping into the trust and familiarity of the Amazon brand, integrating Amazon Pay with WooCommerce is a powerful way to reduce cart abandonment and drive higher sales for your ecommerce business.

Get set up and live within minutes, straight from the WordPress dashboard, by following these steps:

- Sign up with Amazon Pay

- Download the Amazon Pay extension from WooCommerce.

- In your WordPress dashboard, go to Plugins → Add New and upload the extension file.

- Activate the extension.

- Select Connect to Amazon Pay, sign into your Amazon Pay account, and click “Transfer access keys.”

For more information, visit the help page.

##

- Baymard Institute. “Shopping Cart Abandonment Rate Statistics.” Baymard Institute, www.baymard.com/lists/cart-abandonment-rate.

- Comscore custom study for Amazon Pay comparing conversion rates between Amazon Pay and native merchant checkouts in the U.S. over a 6-month period from October 2021 to March 2022, n=40.

- Consumer NPS Surveys: Conducted by Amazon Pay in 2022 among U.S. consumers who had used Amazon Pay in the 1-month preceding the survey launch dates, n=3855.

- Active customer accounts represent accounts that have placed a paid order during the preceding twelve-month period.

About

Latoya Duffus

Latoya is a partner marketing manager at Woo, with a background in B2B tech marketing. In her free time she enjoys hiking across her home island of Jamaica and travelling. She’s hiked the Blue mountain peak three times.