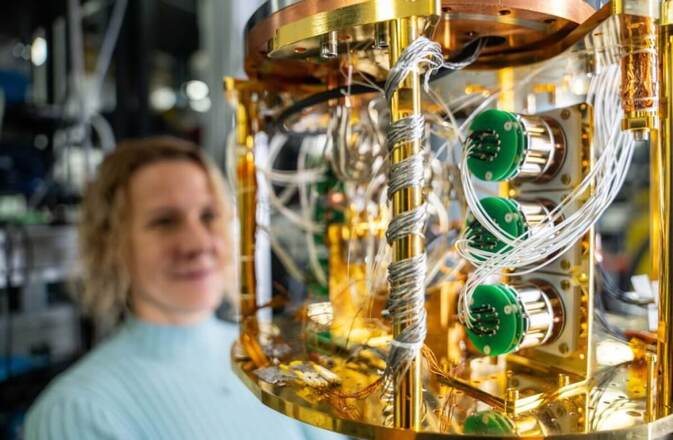

Photonic, a company focused on building distributed quantum computing systems, has secured CAD $180 million (approximately USD $130 million) in the first close of its latest financing round, signaling continued momentum in the race to commercialize fault-tolerant quantum technology.

The investment brings Photonic’s total funding to CAD $375 million (USD $271 million) and reflects growing confidence among both financial and strategic investors in the company’s technical roadmap and market potential.

The funding round was led by Planet First Partners, with new participation from Royal Bank of Canada (RBC), TELUS, and additional undisclosed investors. Existing backers, including the British Columbia Investment Management Corporation (BCI) and Microsoft, also reinvested. With the capital infusion, Photonic plans to accelerate product development milestones, expand its engineering and commercial teams, and deepen relationships with early customers and ecosystem partners as it moves closer to delivering commercially viable quantum systems.

Photonic is pursuing a differentiated approach to quantum computing built around what it calls an “Entanglement First” architecture. Rather than scaling quantum processors as monolithic systems, the company combines silicon-based qubits with native photonic interconnects, allowing quantum processors to be distributed and linked using existing fiber-optic telecommunications infrastructure. This model is designed to address one of the most persistent challenges in quantum computing: scaling systems while maintaining stability, coherence, and error correction at useful levels.

Investors backing the company point to this distributed design as a credible pathway toward utility-scale quantum computing, particularly in applications that demand significant computational complexity. Planet First Partners Managing Partner Nathan Medlock, who will join Photonic’s board as part of the investment, highlighted the potential for quantum computing to drive advances in areas such as clean energy, advanced materials, and life sciences. According to Medlock, Photonic’s architecture could enable faster progress in battery chemistry, low-carbon industrial processes, and drug discovery – fields where classical computing faces fundamental limitations.

Photonic’s Technical Direction

Photonic CEO Paul Terry said the latest funding round reflects both confidence in the company’s technical direction and growing cross-industry interest in quantum technologies. He noted that the investor base now includes organizations from sectors expected to be among the earliest beneficiaries of quantum computing, including telecommunications, financial services, sustainability, and security. Terry added that the company remains focused on turning decades of theoretical promise into deployable systems that can be integrated into real-world workflows.

For RBC, the investment marks its first direct equity stake in a quantum computing company. Barrie Laver, Managing Director and Head of Venture Capital and Private Equity at RBC, said the bank sees potential for Photonic’s technology in financial applications ranging from cryptographic security to portfolio optimization and advanced risk modeling. Laver emphasized the importance of scalable architectures in moving quantum computing from research environments into regulated, mission-critical industries.

TELUS Global Ventures echoed that view, framing quantum computing as a foundational technology for the future of secure communications. Managing Partner Terry Doyle said Photonic’s work aligns closely with TELUS’s long-term vision for next-generation telecommunications infrastructure, particularly as quantum networking and quantum-safe security become more relevant for global data flows.

BCI, one of Photonic’s earliest and largest shareholders, pointed to the company’s technical progress and capital efficiency since its initial investment. CEO and Chief Investment Officer Gordon J. Fyfe said Photonic has consistently advanced key engineering milestones while forming strategic commercial partnerships, positioning it as a strong contender in the push toward fault-tolerant quantum systems.

As governments and enterprises increase investment in quantum research, Photonic’s latest funding underscores a broader shift toward architectures designed for scalability, interoperability, and commercial deployment. While significant technical hurdles remain before quantum computing reaches widespread adoption, the company’s growing financial backing suggests that investors see distributed quantum systems as a promising route toward practical impact.

Executive Insights FAQ

Why is distributed quantum computing attracting investor interest?

Distributed architectures offer a potential solution to scaling challenges by linking smaller quantum systems rather than building single, extremely complex processors.

What differentiates Photonic’s approach from other quantum players?

Photonic combines silicon-based qubits with photonic interconnects, allowing systems to scale over existing telecom fiber infrastructure.

How close is Photonic to commercial deployment?

The company is advancing toward commercialization through staged milestones, though fault-tolerant, large-scale systems remain a multi-year challenge.

Which industries could benefit first from Photonic’s technology?

Early applications are expected in materials science, energy, telecommunications, finance, and security-sensitive environments.

What does this funding round signal for the quantum computing market?

It indicates increasing investor confidence in scalable architectures and a shift toward commercially oriented quantum platforms.