If you run a SaaS company, particularly in the B2B landscape, you’ll know how complicated managing revenue can be. Creating convenient billing experiences, managing invoices and subscriptions, and adhering to tax and compliance rules can be complex.

Not to mention, there’s are the challenges of choosing the right pricing structure, finding ways to retain your customers, and protecting buyers from fraud to consider too.

Paddle aims to address all of those roadblocks for SaaS brands. This leading “merchant of record” offers a complete ecosystem of tools that makes payment management simpler, more secure, and more efficient for business leaders.

After reading a number of positive reviews about the platform, I decided to put it to the test for myself, to tell you everything you need to know about the system.

We conduct hands-on reviews of all the products and services we discuss. Visit our research methodology page to learn more about our process.

Quick Verdict, Pros and Cons:

Paddle is a straightforward and powerful revenue delivery platform, designed specifically for B2B SaaS businesses.

In my opinion, it offers a fantastic one-stop-shop for all of the features most of these companies rely on, whether you’re looking for help managing subscriptions, or choosing pricing structures.

However, it is quite a niche product, with a slight learning curve for beginners.

Pros:

- Comprehensive platform for revenue management

- Exceptional support for international payments

- Managed tax, payment, and data compliance

- Excellent pricing structure

- Free tools to help boost your revenue

Cons:

- Slight initial learning curve

- Quite a niche-focused product

What is Paddle? An Overview

First, it’s worth clarifying what Paddle actually is. I’ve seen this solution compared with a lot of payment processing platforms, like Stripe, but Paddle is actually a very different create.

It’s a “revenue delivery platform”, that helps SaaS companies put their billing operations on autopilot.

The company is the first to use the “Merchant of Record” model for SaaS companies. Basically, this model gives businesses the option to offload operational work to a third party.

With Paddle, you can hand the responsibility of taking payments, and dealing with sales tax over to another company, giving you less work to worry about as you grow your business.

The Paddle platform or “suite” gives you access to an all-in-one payments infrastructure, with tools for billing, profit metrics, intelligent pricing, customer retention, and analytics.

The Billing Features

I wanted to start this review with the “heart” of Paddle’s ecosystem – its robust billing features.

Paddle gives you all the tools you need to manage transactions as a SaaS company with ease. Here’s a quick run-down of all the great billing features you can access:

The Checkout

With Paddle, you’ll gain access to a customizable checkout for your store, that matches your brand and user interface.

There are actually a host of customization options to choose from, and once you design your checkout you can easily integrate it into any platform or storefront.

Not only is the checkout solution fully SOC2 certified, and 3DSecure ready, but it’s GDPR compliant for European companies, and helps organizations to adapt to global regulations, with complete tax compliance and fraud protection features for every region.

More importantly, the Paddle checkout can automatically adapt to your customer. It identifies the location of each buyer, and rapidly shows localized payment methods, different currencies, and translates any language too.

Payments and Invoicing

The Payments feature from Paddle is great at minimizing the need to build a comprehensive payments stack from scratch. You get banking relationships and payment infrastructure already built-in, and Paddle’s technical team can also optimize your solution to suit your needs.

Paddle’s payments systems supports more than 29 different currencies, as well as all of the top payment methods, such as Google Pay, Apple Pay, and PayPal, so you can adapt the transaction process to suit your customers.

Alongside Payments, Paddle also gives merchants a full invoicing solution, that streamlines invoice creation and delivery.

You can use the Paddle Billing API to automate the process of filling out invoice details and sending documents to customers. Plus, the Billing API automatically reconciles everything for you, so you don’t have to manage the process yourself.

Tax, Compliance and Fraud Prevention

Probably the most impressive thing about Paddle, in my opinion, is how much it reduces headaches associated with taxes and compliance – even for global SaaS brands. As mentioned above, since Paddle is a “Merchant of Record” it handles all of your tax and compliance issues for you.

Paddle will automatically calculate tax and VAT charges for over 100 jurisdictions, and collect these payments from customers during the payment process. It’s also fully compliant with all of the top regulatory guidelines (as mentioned above), such as PCI-DSS.

For even greater protection against emerging threats, Paddle also offers access to a range of fraud prevention tools and services.

The company can analyze transactions for you and keep you alerted about suspicious behavior. Plus, the team will actively fight chargebacks for you, to ensure you don’t lose money to fraudulent requests.

Reporting and Analytics

On top of all the features mentioned above, Paddles billing system comes with a fantastic reporting and analytics toolkit.

I actually think the company has some of the best reporting tools I’ve seen in the industry.

You can access real-time dashboards that showcase your revenue, active customers, and various other important metrics.

You also get integrated ProfitWell metrics, which makes it easy to build comprehensive reports about subscription revenue.

Paddle can automatically collect data from a range of different environments to complete your reports, and it gives you tools for advanced segmentation and opportunity discovery.

Plus, the Paddle team is always on-hand to offer expert analysis and in-depth insights into ways you can improve your conversions or increase revenue.

Beyond Billing: Other Key Paddle Features

Although billing management is the core of the Paddle ecosystem, the company also offers access to various other valuable tools (some of which are available to all users for free). Here’s a rundown of what you can use with your Paddle subscription.

ProfitWell Metrics

The ProfitWell metrics module basically builds on the reporting and analytical capabilities you already get built into Paddle’s billing tools.

It’s available for free to all users, and is incredibly intuitive. Once you sign up for an account, you’ll be able to create custom dashboards and reports showcasing all the KPIs that matter most to SaaS businesses.

For instance, you can monitor monthly recurring revenue, churn rates, upgrades and downgrades, customer lifetime value, revenue per customer, and active customers. Even better, this system integrates seamlessly with all of your payments tools with a single click.

You can even use ProfitWell to get a real-time view into which of your customers might be losing interest in your products, or which loyal buyers you can target with cross-sell and upsell opportunities.

Plus, you get benchmark data from over 30,000 SaaS brands, so you can compare your performance to your competitors over time.

Price Intelligently

The “Price Intelligently” offering from Paddle is actually a service, rather than a product. It gives you access to a dedicated team of monetization experts who can assess your financial performance and metrics, and give you strategies to increase your growth.

Paddle will compare your pricing strategies to other SaaS companies in your industry, look at customer purchasing behaviors, and give you comprehensive resources to guide your decisions.

For instance, they can create quantified buyer personas on your behalf, deliver insights into your value metrics, and suggest ways to bundle products.

I was really impressed by the level of effort the Paddle team puts into creating custom plans for companies based on genuine, in-depth research and analysis. If you’re looking for advanced help with pricing, Paddle is a great choice.

Retain

Retain from Paddle is a set of services and tools intended to help SaaS companies hold onto more of their customers. I think that’s pretty relevant in today’s market, where retention is becoming increasingly difficult for B2B brands.

You essentially get a comprehensive dashboard where you can access data that helps you to fight back against churn.

For instance, you can use proactive dunning systems to minimize and resolve failed payments issues. You can also create automated offboarding strategies where you collect insights from customers that abandon your company, to proactively improve future retention.

Retain also gives you a way to automatically reach out to customers with different offers and messages based on their needs.

For instance, you can send messages to loyal customers with bonus offers to increase customer lifetime value, or entice disengaged customers with new pricing options and billing strategies.

All around, Paddle is great at making retention easy.

Quick Summary

| Checkout | Customizable checkout with global tax compliance, fraud protection, localized payments, and multiple currencies. | Highly customizable, global support, easy integration, fraud protection. | Initial learning curve for beginners. | SaaS businesses selling internationally that need localized payments and fraud protection. | B2B SaaS companies with international customers. |

| Payments and Invoicing | Supports 29+ currencies, major payment methods like Apple Pay and Google Pay. Provides full invoicing solution with automated reconciliation. | Supports multiple currencies, automates invoicing and reconciliation. | Can be complex to implement fully depending on the setup. | Companies managing global payments, subscriptions, and invoicing across different platforms. | Businesses managing high volumes of transactions and invoicing. |

| Tax, Compliance, and Fraud Prevention | Automated tax and VAT calculation for 100+ jurisdictions, full compliance with PCI-DSS, fraud detection, and chargeback prevention. | Complete tax compliance, fraud prevention, global regulatory support. | May require additional setup for specific regions or regulatory needs. | SaaS companies dealing with cross-border transactions, tax laws, and compliance. | SaaS companies working across multiple global markets. |

| Reporting and Analytics | Real-time dashboards for revenue, customers, and other metrics. Includes ProfitWell metrics for advanced reporting. | Advanced real-time analytics, comprehensive reporting, segmentation tools. | Data-heavy and may require time to set up dashboards. | Any SaaS business that needs insights into revenue, customer lifetime value, and churn. | Companies seeking real-time insights into business performance. |

| ProfitWell Metrics | Free tool for monitoring MRR, churn, upgrades/downgrades, CLV, and active customers with benchmarking data from 30,000+ SaaS brands. | Free for all users, intuitive metrics with benchmarks, great for monitoring key SaaS KPIs. | Limited to specific SaaS KPIs, additional setup required for custom metrics. | Ideal for startups or growing SaaS companies monitoring revenue metrics and churn. | SaaS businesses looking for easy access to financial metrics. |

| Price Intelligently | Service providing monetization experts to assess financial performance, compare pricing strategies, and create custom growth plans. | Personalized pricing advice, deep industry insights, tailored monetization plans. | Premium service requiring direct contact for custom pricing plans. | Companies wanting expert advice on pricing strategies to enhance growth. | SaaS companies needing personalized pricing and monetization advice. |

| Retain | Retention-focused tools like dunning systems, automated offboarding strategies, and personalized offers to prevent churn. | Improves customer retention, prevents churn with automated actions and insights. | Retention strategies may not work equally well for all business types. | SaaS brands focused on reducing churn and increasing customer lifetime value. | SaaS companies aiming to optimize customer retention and reduce churn. |

Paddle Pricing and Fees

I expected Paddle’s pricing to be a lot more complicated than it actually is. Overall, you get two main “plan” options to choose from.

The first is the “Pay as you go” option, which charges you 5% plus 50 cents for every successful checkout transaction.

This comes with all of your automated tax compliance services, as well as protection against fraud and chargebacks. Although those fees might seem expensive, Paddle is actually a lot cheaper than having to pay for numerous different features separately.

For instance, if you wanted to get the same services from Stripe, you’d have different fees to pay for subscription management, payments, checkout customization, fraud protection, upsell insights, reporting tools, and so on.

The alternative plan is the “Custom pricing” option. This is designed specifically for large scale businesses, and gives you the option to request additional premium services, like a success management team, custom integration options, and help from the “Price Intelligently team”.

If you don’t choose the custom priced plan, you can still work with the “Price Intelligently” experts, but you’ll need to contact Paddle directly.

Notably, Pricing also offers a custom pricing model for companies selling subscription products for less than $10, and those who require dedicated invoicing solutions.

Paddle Review: Ease of Use and Customer Support

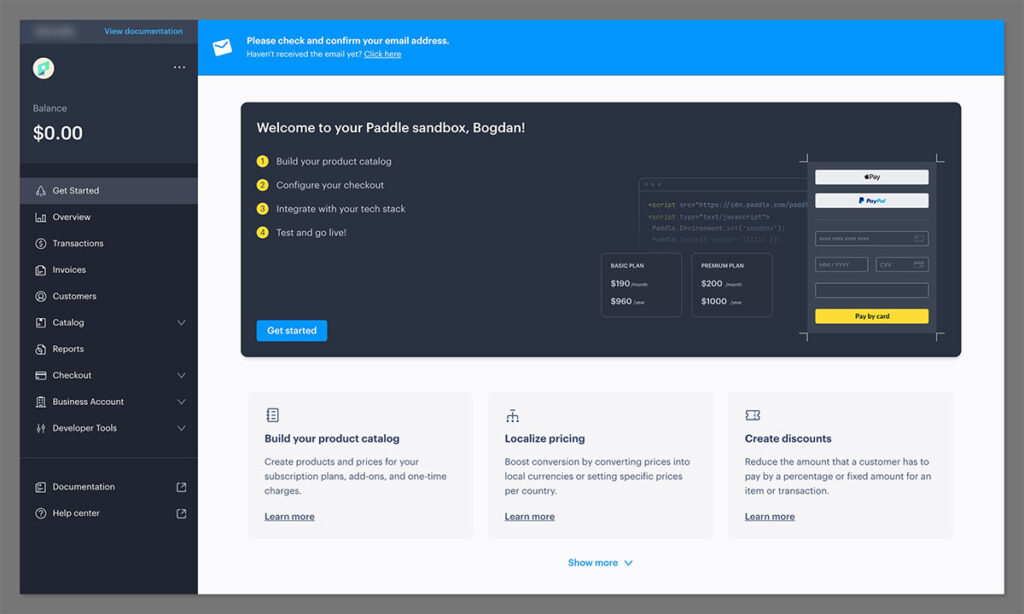

The team behind Paddle created their solution to reduce the hassle associated with selling B2B SaaS products. As a result, actually using the ecosystem of tools is incredibly straightforward – once you get the hang of it.

There’s a little bit of initial complexity when you’re setting up your system for the first time, although Paddle does provide guidance with this.

Certain steps, like setting up subscription rules, customizing your checkout, entering tax and compliance details, and integrating Paddle with your existing systems all take time.

They’re not exhausting processes, but they do require a little commitment.

However, for the most part, Paddle makes managing billing and subscriptions extremely intuitive. From a customer service perspective, Paddle truly excels.

Even before you start implementing your tools, the team will get to know your needs and requirements, to help guide you through the process.

Once you’ve got everything set up and running, Paddle’s technical team is always on hand to help you via chat or email.

Plus, there’s a fantastic help center you can explore too. Moreover, it’s worth remembering that Paddle offers access to additional services, and advisory support for large-scale companies and those who need help with pricing strategies too.

Paddle Review: The Verdict

It’s hard to compare Paddle with any other software I’ve tried in the payment management space. It’s not your standard payment processing solution, nor is it just an app for managing subscriptions and accessing analytics.

Paddle effectively combines everything B2B SaaS businesses need into a single package for success.

While you may need to invest a little more into getting the full experience (such as paying for access to the pricing experts), I think Paddle is well worth the investment.

If you’re looking for growth in the B2B SaaS space, this is one of the best payment management solutions around.