Global spending on cloud infrastructure services reached $102.6 billion in the third quarter of 2025, marking a 25% year-on-year increase and underscoring the sector’s continued momentum, according to new research from Omdia.

The quarter represented the fifth consecutive period in which growth remained above 20%, signaling sustained demand even as enterprises navigate economic uncertainty and rising infrastructure costs. Analysts point to the rapid maturation of artificial intelligence workloads as a central driver, with organizations moving decisively from experimentation toward production-scale deployments.

The data suggests that cloud providers are entering a new phase of competition. Rather than focusing solely on incremental gains in model performance, hyperscalers are increasingly emphasizing platform-level capabilities designed to support multi-model environments and the reliable operation of AI agents in live business settings. This shift reflects enterprise priorities around resilience, governance, and cost control as AI systems become embedded in core workflows.

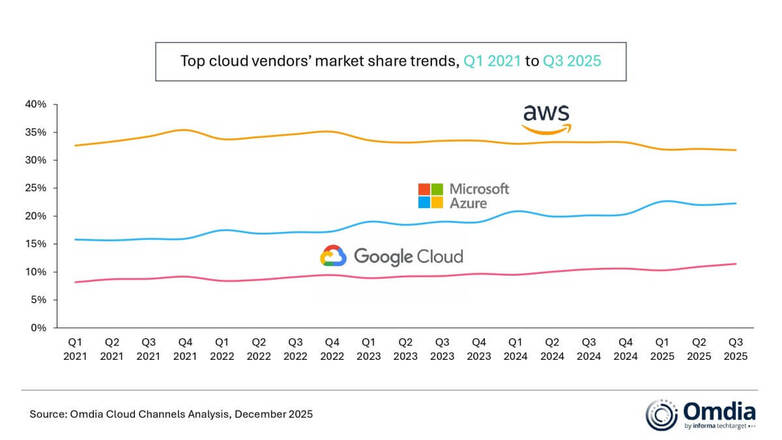

During the quarter, Amazon Web Services, Microsoft Azure, and Google Cloud maintained their market rankings, together accounting for 66% of global cloud infrastructure spending. Combined, the three hyperscalers delivered 29% year-on-year growth. Omdia noted that backlog levels across these providers continued to rise, reinforcing the view that demand remains structurally strong rather than cyclical.

AWS led the market with a 32% share and recorded 20% year-on-year growth, its strongest performance since 2022. The rebound was supported in part by easing compute supply constraints, alongside new AI-driven demand linked to its partnership with Anthropic. By the end of Q3, AWS reported a total backlog of approximately $200 billion, highlighting long-term visibility into future revenue. The company continued to expand Amazon Bedrock, its managed AI platform, increasing model choice with support for Claude 4.5, 18 managed open-weight models, and enhanced governance features such as Guardrails and data automation tools. At its re:Invent 2025 conference, AWS also unveiled the Nova 2 model family, Nova Act, and Nova Forge, reinforcing its strategy to deliver an end-to-end AI stack spanning models, agents, and automation. Infrastructure expansion remained a priority, with the launch of a new Asia Pacific region in New Zealand adding three availability zones to address data residency and latency requirements.

Microsoft Azure retained second place globally with a 22% market share and delivered 40% year-on-year growth. The company renewed its partnership with OpenAI in October, further anchoring OpenAI’s development and deployment on Azure. Azure AI Foundry broadened its ecosystem, supporting more than 11,000 models and serving over 80,000 customers worldwide. In the same period, Microsoft introduced the Microsoft Agent Framework, aimed at enabling enterprises to build and orchestrate multi-agent systems. Early adopters such as KPMG have already applied the framework in production environments, including audit processes, contributing to Azure’s growth momentum. Microsoft also announced continued regional investment, including plans to expand its Azure footprint in Malaysia and to launch a new data center region in India in 2026.

Google Cloud remained the third-largest provider, increasing its market share to 11% and delivering 36% year-on-year growth. Enterprise AI offerings were a key contributor, with quarterly revenue from AI services reaching several billion dollars. Google Cloud’s backlog rose sharply to $157.7 billion as of September 30, up from $108.2 billion in the previous quarter, indicating accelerating demand. On the platform side, Vertex AI’s Model Garden expanded its portfolio with new multimodal models, including variants from the Gemini 2.5 series, Kimi K2 Thinking, and DeepSeek-V3.2. In October, the company launched Gemini Enterprise, positioning it as a unified AI platform that combines foundation models with enterprise-grade agents, no-code tools, and governance features.

Omdia analysts emphasized that multi-model support is becoming a baseline requirement for production deployments rather than a differentiating feature. Enterprises are increasingly seeking flexibility to combine proprietary, third-party, and open-weight models to manage costs and mitigate vendor lock-in. Rachel Brindley, senior director at Omdia, noted that collaboration across the ecosystem remains critical as organizations scale generative AI workloads.

Another emerging focus is the operationalization of AI agents. Yi Zhang, senior analyst at Omdia, observed that while interest in agents is high, many enterprises still lack standardized building blocks to support compliance, business continuity, and customer experience simultaneously. Hyperscalers are responding by introducing platform-led services such as AWS AgentCore and Microsoft’s Agent Framework, which aim to simplify the build-and-run lifecycle for AI agents in production.

Omdia defines cloud infrastructure services as the combined market for bare metal as a service, infrastructure as a service, platform as a service, container as a service, and serverless offerings delivered by third-party providers over the internet. As AI workloads increasingly dominate cloud demand, the research suggests that growth will remain resilient, but competition will hinge on how effectively providers can deliver scalable, governable, and production-ready AI platforms rather than isolated model innovations.

Executive Insights FAQ

What is driving the 25% growth in cloud infrastructure spending?

The primary driver is enterprise-scale deployment of AI workloads moving beyond pilots into production environments.

Which providers dominate the global cloud infrastructure market?

AWS, Microsoft Azure, and Google Cloud together account for roughly two-thirds of global spending.

Why is multi-model support becoming important?

Enterprises want flexibility, resilience, and cost control by combining proprietary and open-weight AI models.

How are hyperscalers addressing AI agent deployment challenges?

They are introducing standardized platform services to simplify building, deploying, and operating AI agents.

What does rising backlog indicate about the market?

Growing backlogs signal strong long-term demand and revenue visibility for leading cloud providers.