The Asia-Pacific public cloud market is entering a new phase of expansion that could see spending more than double by the end of the decade. According to the International Data Corporation’s (IDC) latest Worldwide Software and Public Cloud Services Spending Guide, the region’s public cloud market is projected to grow from $53 billion in 2024 to $131 billion by 2029.

This acceleration, driven by artificial intelligence, digital transformation, and IT infrastructure modernization, represents a compound annual growth rate of 19.8% over the five-year period.

The surge reflects a broad shift across industries to adopt Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) as part of larger strategies to enhance efficiency and innovation. Sectors such as banking, government, and healthcare are leading this transformation, investing heavily in cloud-native technologies to improve service delivery, streamline operations, and unlock new business models.

IDC analysts note that these investments are increasingly being tied directly to broader corporate goals, signaling that cloud adoption is no longer a purely technical decision but a strategic imperative.

Organizations are also demanding higher levels of security, resilience, and availability as they migrate critical workloads to the cloud. The integration of AI into cloud platforms is reshaping business priorities, with companies relying on cloud vendors and managed service providers to deliver specialized services that can support advanced use cases. IDC expects the SaaS segment alone to double in size during the forecast period, fueled by new applications of AI that enhance customer engagement, personalization, and operational automation.

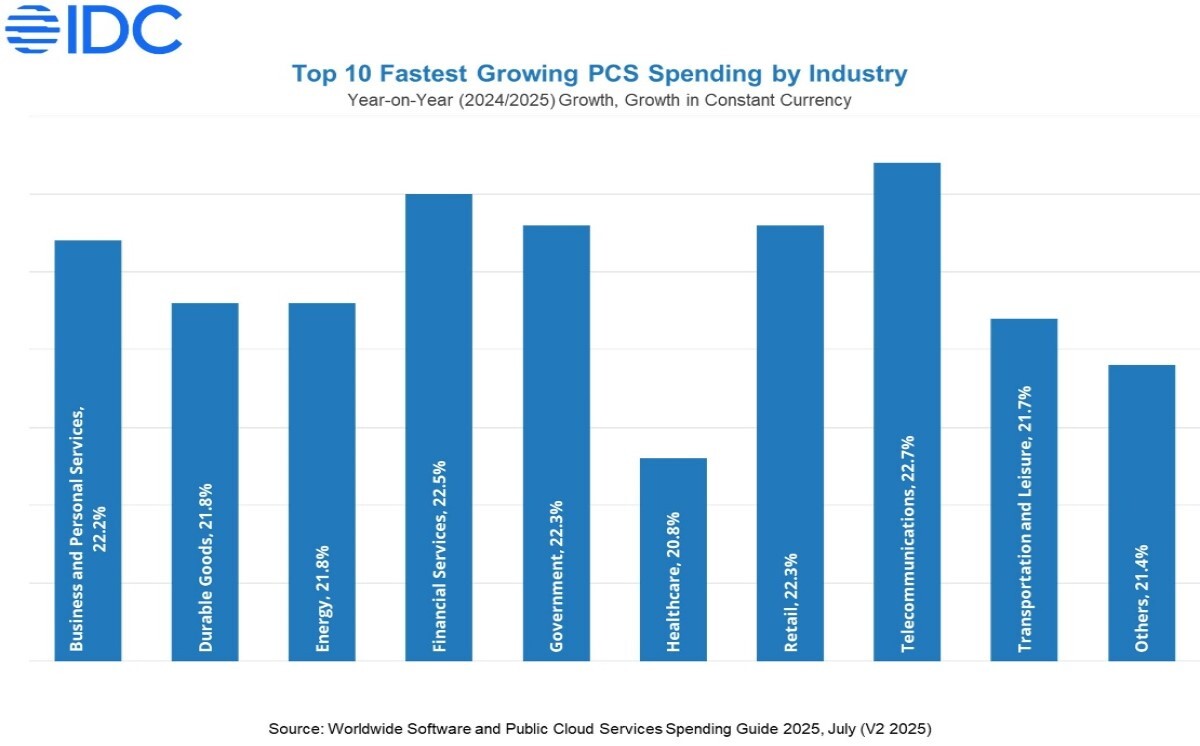

Mario Allen Clement, research manager for Data and Analytics at IDC, emphasized that the growth underscores the region’s commitment to cloud-native strategies and modernization despite persistent challenges. “Cloud is becoming a fundamental component of operations in sectors like financial services, retail, and telecoms, where we’re seeing especially significant growth,” he explained. He added that investments in sovereign cloud solutions and the rising demand for IaaS, PaaS, and SaaS point to Asia-Pacific’s growing influence on the global cloud landscape.

-story continues below the graphic –

Networking Equipment and Servers

Telecommunications and financial services are two of the fastest-moving industries in this shift. Telecom operators are modernizing their networks to support higher data demands and new digital services, while financial institutions are adopting public cloud solutions to accelerate the transition to digital banking. Retail, e-commerce, and government-led digital initiatives are also fueling adoption. At the same time, IDC highlights that some sectors such as healthcare and durable goods may face more difficult cost challenges, with tighter margins potentially slowing adoption rates.

Trade policies could also play a role in shaping adoption patterns. IDC notes that additional tariffs on imported hardware such as networking equipment and servers might raise the upfront cost of building cloud infrastructure in the region. While this could temporarily slow adoption for some organizations, it could also accelerate reliance on established public cloud providers with existing data center investments, shifting demand away from in-house infrastructure.

Despite the strong outlook, obstacles remain. Talent shortages in cloud and AI skill sets continue to challenge enterprises, while the migration of legacy systems slows the pace of some projects. To mitigate these risks, many organizations are adopting hybrid and multi-cloud strategies that allow interoperability and flexibility, easing application migration across environments. Data residency laws and sovereign cloud initiatives are also shaping adoption patterns in markets like Australia, India, and Singapore, where regulatory compliance is a driving factor.

Short-term spending may be affected by broader macroeconomic pressures, including inflation and geopolitical tensions, yet IDC suggests that the region’s long-term focus on modernization will continue to outweigh these challenges. The combination of cloud-native architectures, AI-driven applications, and resilient infrastructure is expected to underpin steady growth for years to come.