Getting ahead in the ecommerce landscape isn’t easy, particularly as online trends continue to evolve. It can be difficult to know where your ecommerce platform stands in comparison to all of the other major market leaders in your space. That’s where the eCommerce Maturity Index comes in.

Designed by SmartProxy, a world-leading provider of web data collection solutions, the eCommerce Maturity Index or “EMI”, offers a deep-dive view into ecommerce website performance, focusing on key factors that affect the customer experience in the online world.

Aside from giving companies a broad overview of which countries, and industries are excelling in the ecommerce space,

Here’s everything you need to know about the index.

What is the eCommerce Maturity Index?

The eCommerce Maturity Index is a data-driven assessment of user experiences across all five continents on modern ecommerce platforms.

It’s a tool designed to help users evaluate the progress of ecommerce businesses worldwide, and make valuable decisions for website optimization.

The index delivers insights drawn from more than 120 ecommerce websites across 40 countries, and evaluates 28 criteria key to various elements of the customer journey.

This resource builds on Smartproxy’s existing portfolio of proxy infrastructure tools and scraping APIs that companies can use to access data insights and gain a competitive edge in the dynamic online retail space.

According to the CEO of Smartproxy, Vytautas Savickas, the EMI will be an invaluable tool for companies looking for ways to better understand their market position, and identify key areas where they need to improve the user experience.

How Smartproxy Evaluated Ecommerce Platforms

Smartproxy examined ecommerce platform performance by looking at various key “sub dimensions” of maturity rankings, focusing on each essential stage of the customer journey. Here’s an in-depth overview of each subdimension:

Browsing

The Browsing dimension evaluated how easily customers could find products, and save them for later, primarily focusing on search quality, product indicators, and filtering options.

The overall score achieved by all of the ecommerce platforms reviewed was actually the highest in this section (62%).

However, sites in certain countries did perform better than others.

The average score for Sweden, Lithuania, and Belgium was 81% for instance, compared to 76% in the United States, suggesting US stores have more work to do to improve the browsing experience.

Reviewing

This subdimension focused on assessing how easy it was for customers to learn about the specifications and features of a product, compare items, ask questions, and access reviews from other clients, and industry experts.

It also examined the overall performance of customer experience strategies on ecommerce platforms.

With an average score of around 39.2%, it seems that a lot of ecommerce companies could benefit from making the review experience better for their customers.

However, companies will need to be cautious about how they source and expose reviews, as 67% of consumers say they value authenticity when reading comments from other customers.

North America seems to be making significant strides in this area, with platforms in the region recording a 35% increase in verified customer feedback.

In fact, the United States performed the best in the Reviewing assessment overall, with a score of 86%, followed by Canada and the Netherlands with equal scores of 71%.

Investigating

The Investigating dimension looked at whether ecommerce platforms provided enough background information on products, such as warnings, safety information, and details about recycling, sustainability and ethical sourcing.

Unfortunately, the results weren’t good in this dimension – the average overall score was only 9.6%. This indicates that many ecommerce companies still fail to be as transparent as could be about their product information.

European companies did achieve better scores overall, however, alongside Canada, with 33.3% and 25% feature scores respectively.

This could have something to do with Europe’s focus on regulatory compliance, and the increasing importance of GDPR in the region, which has resulted in higher consumer trust throughout the region.

Expanding

In this dimension, Smartproxy looked at the extent to which customers could access additional products, services, financing options, and bundling solutions with their purchase.

Overall, the evaluated platforms performed better in this area than in the investigating dimension, with an average score of around 39.7%.

However, Smartproxy noted that there was a lot of diversity between regions in their evaluation. For instance, Belgium and Estonia achieved an average score of 89% each, while Qatar, Nigeria, Iceland, and Morocco all achieved scores of 0.

Decisions

Finally, the Decisions dimension looked at how well ecommerce platforms enabled users to discover and select multiple delivery options, as well as exploring inventory availability insights, restock and price alert features, and the option to find additional information on pricing and return policy.

Overall, the reviewed platforms achieved an average score of 35.1% in the Decisions segment, with a lot of diversity among top performers.

Again, European companies dominated in this section, however, Saudi Arabia also achieved an impressive score of 57.1%, placing it tied for the top score with the Netherlands and Lithuania.

Surprisingly, Kenya and Nigeria ranked on the index with the combined third-highest score of 47.6% – performing even better than the United States.

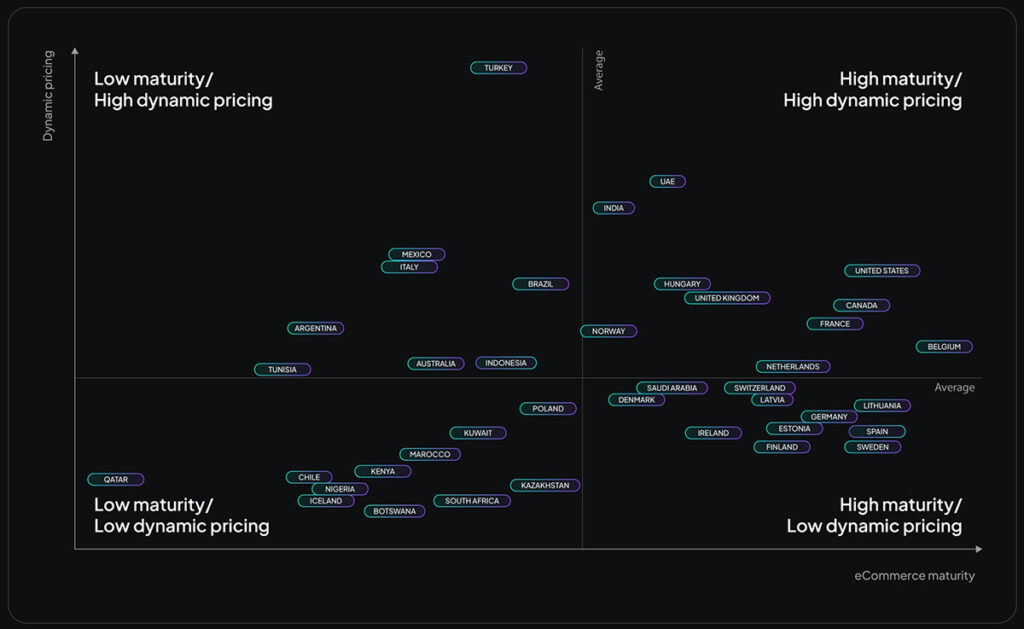

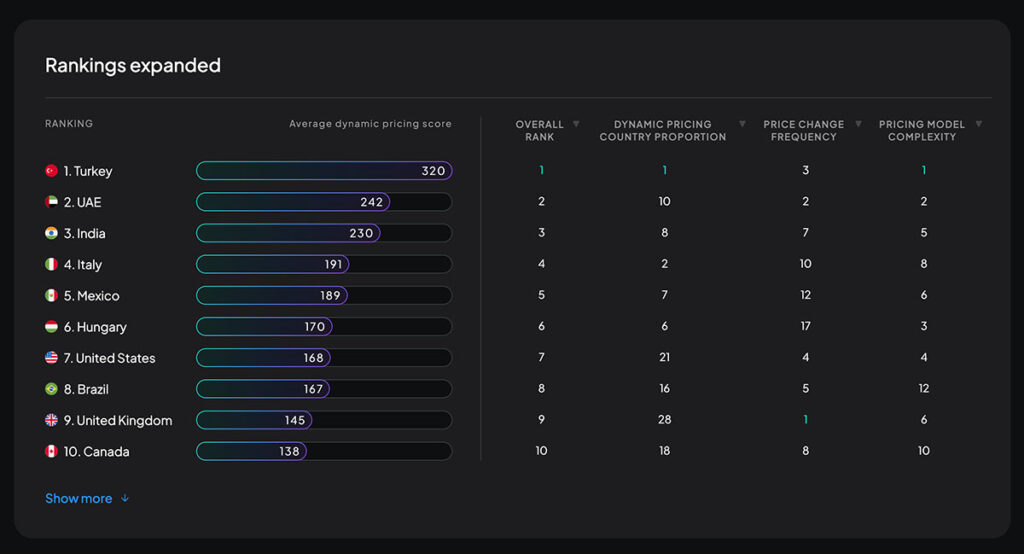

The Dynamic Pricing Index

The Dynamic Pricing Index, offered alongside the index focusing on customer experience, looked at how well ecommerce platforms in different countries embraced dynamic pricing strategies.

This index examined products on ecommerce platforms over a month, with data collected at four-hour intervals throughout the experiment.

Turkey ranked as the number one country for dynamic pricing, followed by the UAE, India, Italy, and Mexico. The United States, Hungary, Brazil, Canada, and the United Kingdom all lagged behind.

According to Smartproxy, the Dynamic Pricing Index evaluated all websites on three main criteria, chosen because the offered a robust framework for evaluating dynamic pricing proficiency:

- Dynamic pricing country proportion: The extent to which dynamic pricing is used throughout different regions- indicating the widespread nature of the strategy.

- Price change frequency: How often pricing is adjusted, demonstrating an ecommerce website’s ability to remain competitive in a fast-paced market.

- Model complexity: The sophistication of the pricing algorithms used, highlighting the platform’s ability to leverage analytics and forecasting techniques.

The Dynamic Pricing Strategies

Overall, the index found that there were numerous pricing strategies used by countries throughout the world, these included:

- Constant price adjustments: The use of gradual price adjustments over time, based on natural market shifts, most commonly used in Denmark, Kuwait, Mexico, Estonia, and Australia.

- Peak and Discount adjustments: Applying discounts and increasing prices during peak periods, most commonly used in Finland, Spain, Argentina, Lithuania and Germany.

- Peak and dynamic discount adjustments: Using three or more discounts or price incrases during peak periods, most commonly used in the UK, Australia, Indonesia, Saudi Arabia, and the Netherlands.

- Consistent micro adjustments: Using multiple small-scale adjustments for testing and understanding price elasticity on a long-term basis, commonly used by Denmark, Kuwait, Mexico, Australia, and Estonia.

- Supply and demand adjustments: Fluctuating prices in response to supply and demand dynamics, commonly used in India, Lithuania, Hungary, Tunisia, and Saudi Arabia.

- Automated pre-set adjustments: Frequent price adjustments based on pre-defined algorithms and rules, commonly used by Italy, Canada, India, UAE, and Indonesia.

- Real-time adjustments: This model involves random price adjustments without a pattern or structure. It’s commonly used in the US, Turkey, Norway, the US, Brazil, and Mexico.

Ecommerce Maturity by Country

Based on its five-stage evaluation process, Smartproxy created a dynamic page where companies can examine the maturity rankings of every country in the index based on the above subdimensions.

The overall top performing companies with the highest combined score across categories were:

- Belgium: 59%

- Lithuania: 55%

- Germany: 55%

- Sweden: 54%

- Spain: 53%

- Estonia: 52%

- United States: 52%

- Finland: 51%

- Canada: 51%

- France: 51%

Smartproxy also arranged countries into certain clusters based on their performance, such as:

Holists

Countries that excel in all aspects of the customer journey in ecommerce, from finding products, to learning about their features, and closing deals. The countries in this category included the United States, Canada, and United Kingdom as well as:

- Belgium

- Spain

- Sweden

- Germany

- Lithuania

- The Netherlands

- France

- India

- Finland

- Estonia

- Latvia

Finders

The countries placed in the Finders segment were those that performed best at finding products helping customers to learn more about them.

However, they had room to improve when it came to bundling and enabling decision making processes. The countries in this section included Switzerland, Ireland, and Hungary, as well as:

- Norway

- Denmark

- Morocco

- Indonesia

- Turkey

Sellers

The countries that fell into the Sellers category excelled at offering bundles and additional services, and where considered highly transparent about pricing, delivery and returns.

However, they didn’t always deliver the best browsing and discovery experience. The UAE was the top performer in this category, followed by:

- Kazakhstan

- Saudi Arabia

- Poland

- Italy

Laggards

Finally, Laggards were the countries that showed the need for the most improvement throughout all stages of the customer journey.

Countries like Mexico and Brazil almost made it into the Seller category, while others fall further behind, such as:

- Australia

- Kuwait

- South Africa

- Botswana

- Nigeria

- Kenya

- Argentina

- Chile

- Tunisia

- Iceland

- Qatar

The Key Takeaways from the eCommerce Maturity Index

Overall, the Smartproxy ecommerce Maturity Index highlights a significant need for improvement in the ecommerce customer journey, even from those who are currently positioned as Holists.

Many vendors still have strides to take if they want to earn customer trust and loyalty.

Smartproxy shared a few key insights for businesses looking to improve in the years ahead:

Europe Leads the Way So Far

At present, European countries lead the way in terms of overall performance on the eCommerce Maturity Index.

Marketplaces in countries like Belgium, Germany, Spain, Sweden and Lithuania all demonstrated an incredible ability to enhance shopper experiences.

According to Smartproxy, for companies in other regions to replicate the performance of businesses in European continents, the main issues they should focus on are:

- Simplifying the process of finding products and comparing them to alternatives.

- Offering robust review and filter options to enhance decision making practices.

- Providing relevant services and bundling options to add value for customers.

- Prioritizing transparency and clarity on ecommerce websites.

Transparency Is Becoming Increasingly Crucial

Consumers are becoming increasingly focused on transparency when choosing which products to buy, and which ecommerce companies they can trust.

The EMI showed a significant disparity across European countries in particular, with only a handful of countries achieving an average score.

Smartproxy notes that providing detailed product information is crucial to not only adhering to evolving compliance standards, but adapting to the new priority of consumers.

Customers are becoming increasingly conscious about the safety and environmental impact of their purchases, and want to ensure they’re supporting ethical brands.

However, US companies only achieved a score of 8.3% in terms of providing access to product details, sustainability and ethical sourcing information.

This could indicate that US companies need to upgrade their ecommerce sites to focus on more comprehensive transparency to boost sales.

Ecommerce leaders should focus on enhancing product listings with detailed descriptions and safety warnings, and promoting sustainable and ethical practices in the years ahead.

Dynamic Pricing is Valuable

Smartproxy noted that dynamic pricing has become increasingly important to enabling revenue increases, and ensuring companies can stay competitive in the ecommerce market.

What’s more, dynamic pricing can help you to boost customer satisfaction and loyalty rates too, by showing your customers you’re committed to giving them the best deal.

On top of that, dynamic pricing can contribute to overall cost reductions, helping you to manage stock levels more effectively, reducing warehouse costs and capital tied up in unsold inventory.

Unfortunately, while the UAE, Turkey, and India are all leading the way in dynamic pricing, with a commitment to frequent price changes, many European companies, and the US have fallen behind.

Additionally, the EMI found that the fashion industry performed best overall among all industries reviewed, largely because of the focus fashion companies have on dynamic pricing models.

Following fashion, multi-category ecommerce website had the highest score for dynamic pricing. Those websites also performed extremely well across most categories.

According to Smartproxy, Dynamic Pricing is clearly more prevalent in fast-moving sectors where fluctuations are driven by low cost and the minimal maintenance of products.

Industries like electronics face higher production costs, making price adjustments more challenging.

Learning from the eCommerce Maturity Index

Smartproxy’s eCommerce Maturity Index offers an excellent insight into the key steps ecommerce platform owners should be taking to improve the customer experience in the years ahead.

Investing in dynamic pricing strategies, upgrading transparency, and enhancing every stage of the buyer journey, will be crucial for differentiation going forward.