Key takeaways

What are employee benefits?

Employee benefits are non-monetary compensation that employers offer workers. In the U.S., employers usually share the cost of most benefits with their employees.

Benefits are different from employee perks. Although similar, employee benefits are must-have offerings that employees would otherwise pay for out of their income. If you use a house as an analogy, you can think of benefits as your utilities, like water, electricity, and gas.

Perks are nice-to-have offerings that your employees may or may not pay for themselves. They usually reflect your company values since most employees, regardless of classification, can access them. Perks include things like free meals, professional development courses, and discount programs. Using the house analogy, perks are like your fenced-in backyard, attached garage, and garbage disposal.

Outside of benefits required by law, employers in the U.S. have the freedom to customize their employee benefits packages to fit their company’s circumstances and industry expectations.

For example, you may offer benefits that align with employee tenure, like increasing the number of paid time off (PTO) days employees receive in a benefit year with each year of service. Or, you may offer insurance packages based on the employee’s full- or part-time status. However you organize your benefits, make sure all employees in the same or similar circumstances have equal access.

Advantages of offering employee benefits

Employee benefits are a net good for your organization despite the increased labor costs. This is because employee benefits help you:

- Comply with labor laws: You’ll avoid fines and penalties from laws like the Affordable Care Act (ACA), Employee Retirement Income Security Act (ERISA), and Federal Insurance Contributions Act (FICA).

- Attract top talent: Offering top-tier benefits as part of your recruitment strategy can encourage qualified candidates to apply since they help you stand out from competitors.

- Retain talent longer: Employees are more likely to stay long-term if you offer great benefits since they improve employee morale, satisfaction, and well-being.

- Support a diverse workforce: Benefits can support diversity, equity, and inclusion (DEI) through comprehensive PTO to support religious and cultural observations, more affordable healthcare, and flexible work for employee caregivers.

- Align with company values: The benefits you offer can demonstrate your commitment to values like inclusion, teamwork, and community, plus strengthen your company’s brand image.

Global benefits

Compared to other countries, benefits in the U.S. are much more employer-centric. While this allows you to curate employee benefits that fit your industry or company’s unique circumstances, it also means acknowledging that employees rely on you for benefits that other countries mandate by law.

For example, countries like Japan and the United Kingdom have universal healthcare coverage, meaning residents do not have to depend on their jobs for access. Many more countries have robust PTO laws that require employers to pay for parental leave and medical procedures. In 2023, Spain even passed a menstrual leave bill that requires employers to pay for three days of leave for women who experience painful, disabling periods.

Being mindful of benefits worldwide is vital for developing culturally appropriate and relevant benefits offerings for your distributed workforce. It also ensures your benefits align with your company’s values and culture by supporting the range of human needs and experiences.

For instance, if you have employees in both the U.S. and the U.K., you may offer health insurance free of cost to your employees in the U.S. to mirror the benefits coverage of their U.K. counterparts. Such offerings demonstrate your commitment to equity by providing equal access to opportunities and benefits company-wide, regardless of your employees’ locations and backgrounds.

Learn more about how to create an equitable global benefits strategy: An Employer Guide to Global Employee Benefits

Examples of employee benefits

The table below breaks down the most common employee benefits in the U.S., including those mandated by law and popular fringe (voluntary) benefits:

Description

Workers’ compensation

Health and wellness

Provides employees with medical care and partial wage replacement following a work-related injury or illness.

Affordable Care Act (ACA)-qualifying health insurance

Health and wellness

Requires employers with 50 or more full-time employees to offer affordable health insurance to employees.

Health and wellness

Provides health insurance to employees 65 or older; employees and employers fund this through Federal Insurance Contributions Act (FICA) payroll tax.

Social Security

Financial security

Provides a percentage of income to employees after reaching age 65 or older; employees and employers fund this through FICA payroll tax.

Unemployment insurance (UI)

Financial security

Work and life balance

Mandates qualifying employers to provide up to 12 weeks of unpaid, job-protected leave to eligible employees for specific medical and family reasons.

Description

Medical or health insurance

Health and wellness

Dental insurance

Health and wellness

Pays for some or all of employees’ dental care; employees and employers usually pay for this through pre-tax payroll deductions.

Vision insurance

Health and wellness

Pays for some or all of employees’ vision care; employees and employers usually pay for this through pre-tax payroll deductions.

Prescription or pharmacy insurance

Health and wellness

Pays for some or all of employees’ drug prescriptions; employees and employers usually pay for this through pre-tax payroll deductions.

Wellness programs

Health and wellness

Promotes health, well-being, and exercise through workplace offerings, like gym memberships, health screenings, and fitness and mental health stipends.

Short-term (STD) and long-term (LTD) disability insurance

Financial security

Replaces a portion of an employee’s income following a serious injury or illness; employees and employers usually pay for this through payroll deductions.

Financial wellness

Financial security

Provides financial literacy tools, such as money managing courses and earned wage access (EWA), to decrease employees’ financial stress.

Retirement and pension plans

Financial security

Ensures employees receive a portion of income replacement following retirement; employees and employers pay for these through pre-tax payroll contributions.

Financial security

Provides employees with a set income regularly at a later date; qualified employee annuities allow workers to fund it through pre-tax contributions.

Life insurance and death benefits

Financial security

Issues employee beneficiaries a sum of money following an employee’s death; either employees, employers, or both may fund it.

Financial security

Pays for qualified medical expenses from an account that employees contribute pre-tax gross pay; HSAs roll over year after year and FSAs are use-it-or-lose-it accounts.

Relocation assistance

Financial security

Pays wholly or partially for expenses around work relocation, like travel, moving, food, and temporary lodging.

Tuition assistance

Financial security

Assists employees in paying for their education, usually in exchange for taking specific courses or maintaining a certain GPA.

Financial security

Allows employees to buy in and own stock shares of their company in exchange for a portion of its profits.

Paid time off (PTO)

Work and life balance

Provides pay to employees even if they did not work; companies can offer different kinds like paid sick, vacation, personal, bereavement, and jury duty leave.

Work and life balance

Provides pay time off to employees during holidays recognized by the company, such as Independence Day in the U.S.

Premium pay

Work and life balance

Provides income over an employee’s straight-time pay rate to incentivize working undesirable shifts or hours; overtime pay and shift differentials are examples.

Employee assistance programs (EAPs)

Work and life balance

Assists employees in finding solutions to personal problems affecting their work, such as financial, legal, health, and relationship issues.

Commuter benefits

Work and life balance

Lowers the gas, parking, and public transport costs employees pay to get to and from work; employees and employers pay for this through pre-tax payroll deductions.

Flexible work

Work and life balance

Allows employees to vary their work location or start and stop times but maintain the number of hours they work each week to accommodate personal needs, like child care and doctor visits.

Types of employee benefits

The benefits you can offer employees fall into two categories: legally mandated or fringe.

Legally-mandated benefits

Legally-mandated benefits are benefits you must offer your employees by law. In the U.S., federal law requires employers to provide and pay in whole or in part the following employee benefits:

- Workers’ compensation.

- ACA-qualifying health insurance.

- Social Security.

- Medicare.

- Family and Medical Leave (FMLA).

- Unemployment insurance.

Federally-mandated vs. state-mandated benefits

For simplicity, we’ll only discuss federally mandated employee benefits here. However, most states and municipalities require employers to offer additional benefits to employees or more employee-favorable versions of federal benefits.

For example, California, New York, Chicago, Philadelphia, Michigan, and Washington require employers to provide employees with paid sick leave benefits. Some states, like Massachusetts, Colorado, and Rhode Island, even mandate paid family leave, which exceeds FMLA requirements.

Because of this, double-check the laws for your employees’ countries, states, and municipalities to ensure you’re meeting minimum provisions.

Fringe benefits

Fringe benefits are benefits you offer employees outside of those required by law. Because of this, you can also think of fringe benefits as voluntary or discretionary benefits.

There are several types of fringe benefits, but you can sort most into the following categories:

- Health and wellness.

- Financial security.

- Work and life balance.

Fringe benefits and the IRS

The IRS defines fringe benefits as “a form of pay for the performance of services.” It offers examples like providing a company car to commute to and from work, tickets to entertainment events, and discounted services. As a result, the IRS definition of fringe benefits includes both voluntary benefits and employee perks.

The main takeaway is that most fringe benefits and perks are taxable. You should factor their cost into employees’ gross pay for income tax withholding. Exceptions include most health insurance and retirement and pension plans.

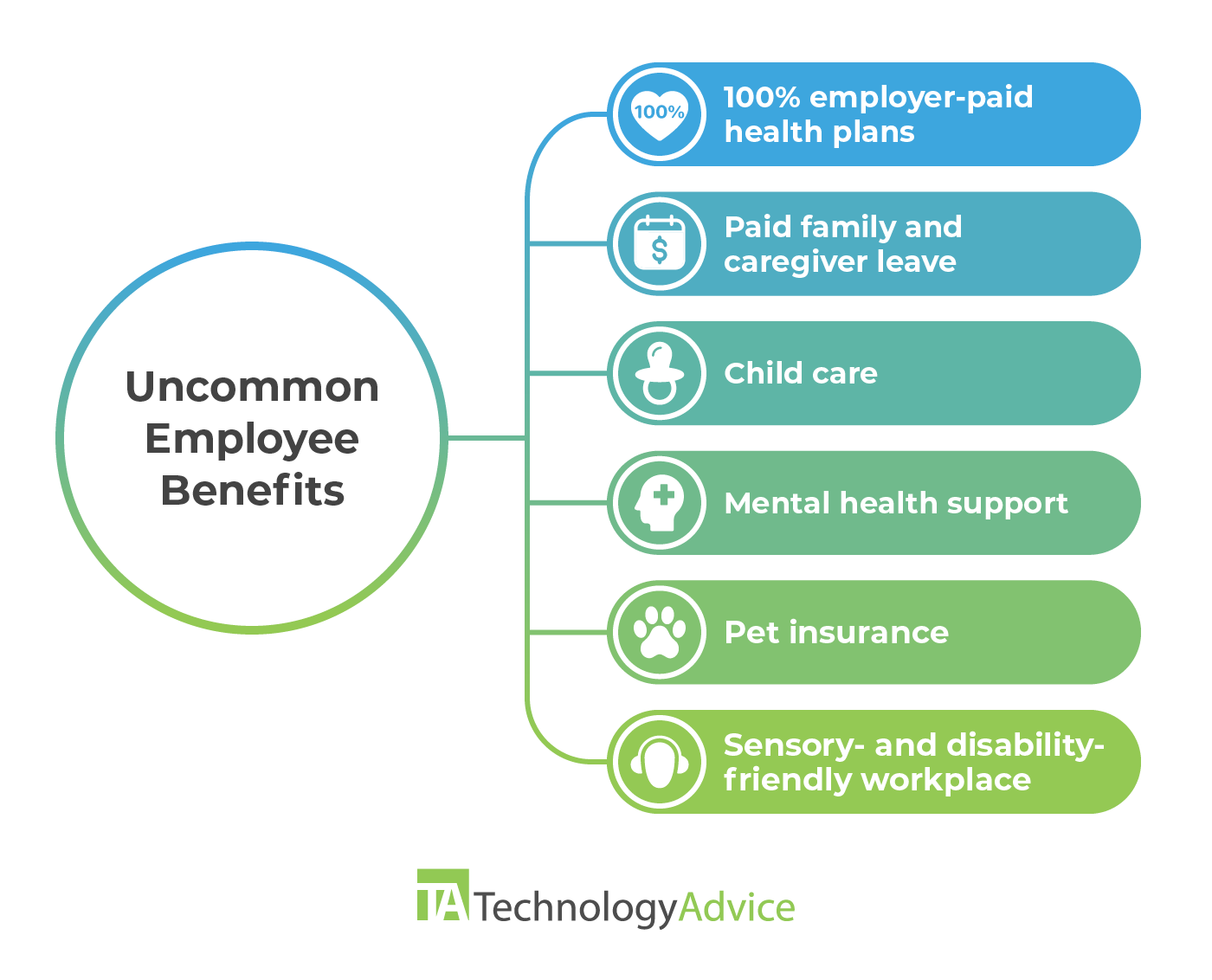

Uncommon employee benefits

If you already offer most of the above benefits in your total compensation package, many lesser-known benefits are growing in popularity. Adding these unique benefits can modernize your employee benefits and make your workplace stand out.

100% employer-paid health plans

Because of the ACA, most employers with over 50 employees offer health insurance benefits. However, health insurance costs and plan coverage vary wildly. Many employees also don’t have a choice in the doctors or care they receive, especially if they choose low-cost, high-deductible plans.

However, completely covering the cost of healthcare plans for employees and dependents can ease employees’ financial stress. This is especially important for employees with ongoing or upcoming medical care needs, such as pre-existing conditions, disabilities, or surgeries.

As a result, 100% employer-paid plans are often more equitable since there are no barriers to enrollment, and employees don’t have to pay more for comprehensive coverage options.

Did you know?

According to a 2023 Deloitte study, women pay $15 billion more than men in out-of-pocket healthcare costs annually. In addition to paying 100% of premiums, consider shopping for insurance plans with robust coverage options for women, including menstrual, menopause, and reproductive support.

You may also want to pay particular attention to each plan’s out-of-state coverage, especially if your employees live in rural areas with limited access to in-network providers. Other things to look out for are each health plan’s support for mental health, telemedicine, and gender-affirming care.

Paid family and caregiver leave

The federal FMLA program only guarantees unpaid leave to eligible employees who work for FMLA-qualifying employers. Offering a paid leave program is extremely attractive to employees, especially those with a medical condition or looking to start a family but concerned about wage loss.

Plus, according to Cheri Wheeler, Vice President and Senior Consultant at Kelly Benefits Strategies, paid caregiver benefits can be a net positive for your company culture and bottom line.

“Caregiving benefits can help improve employee productivity, as employees who are able to manage their caregiving responsibilities effectively are more likely to be focused and engaged at work,” explains Wheeler. In other words, these benefits can reduce employees’ feelings of financial insecurity, stress, and burnout since they have more support and flexibility to manage their personal and professional lives.

The U.S. is only one of six countries without a national paid parental leave policy. Even if you don’t have employees working internationally, offering paid family leave on par with the world can make global expansion easier when the time comes. More importantly, it can keep your employees invested long-term, knowing they are financially protected when they decide to grow their families.

Build your family and caregiver leave policy

Providing paid family leave is fantastic, but pay close attention when crafting your leave policy. A comprehensive family leave program should also cover lactation support, elder care assistance, and family planning. A good leave program also offers ways for employees to negotiate flexible working arrangements, extended leave, and a gradual return to work.

If you’re curious, you can learn more about leave management and parental policy building in our resources below:

Child care

Childcare benefits can take on a variety of forms, such as:

- Stipends to lower costs for child care services.

- Dependent Care Flexible Spending Accounts (DCFSA).

- Discounts at local child care facilities.

- In-office child care centers.

The goal is to help working parents reduce child care costs while continuing to work. If you’re a small business with a limited budget, assisting employees with finding or paying for child care can be more affordable than an employee missing work due to unreliable or unaffordable child care.

Family-building and reproductive assistance

Family-building and reproductive assistance benefits help employees who want to start a family but face obstacles. It includes employer-sponsored offerings like:

While some health care plans and EAPs cover these, carving out family-building benefits can be especially attractive to employees who are:

- Single by choice.

- LGBTQ+.

- Struggling with fertility.

One advantage of offering family-building and reproductive assistance is that it can be unique to your company’s culture and budget.

For example, Cyndi Wenninghoff, the Director of Employee Success at Quantum Workplace, explains that they reimburse employees up to $10,000 per family per year for fertility and adoption services. Such reimbursement programs allow employees to choose the services they want without the limitations of insurance plans.

Mental health support

Mental health support includes benefits that cover the costs of services that improve employees’ psychological and emotional well-being. Most modern health insurance plans include in-network support for mental health, such as counseling, medication, and substance abuse and psychiatric treatment.

You also have options if you don’t offer health insurance or want to fill the gaps in your plan’s mental health coverage. For example, you may wish to add designated mental health days to your PTO plans to provide a reprieve for employees experiencing a crisis. Onsite counselors or applications like Calm and Headspace are other ways to support employees’ mental well-being.

Mental health awareness in the workplace

Despite the strides mental health awareness has made in recent years, there is still a lot of stigma and shame surrounding mental healthcare. Minority groups, like people of color, who want to take advantage of mental healthcare services may have difficulty finding care from providers with knowledge and backgrounds similar to them.

One way to support these groups as an employer is to foster a workplace culture of acceptance through company-wide allyship training and crisis management training for managers. Creating and providing access to employee resource groups (ERGs) is another way for employees to find support in a shared community, even if they are uncomfortable with traditional mental healthcare options.

Pet insurance

Pet insurance is an increasingly popular benefit for employees. 2023 PEW research indicates 62% of Americans own a pet, with 97% saying they are part of the family. Considering the costs of veterinary checkups and routine and preventative care like vaccinations, dental cleanings, and medications, the price of owning a pet can make a severe dent in an employee’s income.

Many businesses are noticing the value of pet insurance for their employees. SHRM’s 2023 Benefits Survey notes that about one in five employers (19%) now offer the benefit compared to 14% in 2022.

Most pet insurance plans reimburse employees for qualified vet expenses for their eligible household pets. Plans can be “illness” or “wellness.” Illness plans cover pets for any unexpected illness or injury, such as cancer, while wellness plans cover routine vet care like exams, vaccinations, and bloodwork. Survey your employees to see which option is the most valuable to them, especially if you want to start offering this benefit.

Sensory- and disability-friendly workplaces

The Americans with Disabilities Act (ADA) requires you to provide reasonable accommodations to employees with disabilities. It also provides public and commercial facility accessibility guidelines. However, sensory- and disability-friendly workplace benefits add a layer of intentionality beyond what the law mandates.

For example, you could create quiet or low-sound rooms with dim lighting to accommodate neurodivergent employees. You may also offer adjustable tables, desks, and chairs in your employee break rooms and office areas to accommodate employees of different heights. Wide walkways also make it easier for employees in wheelchairs to navigate.

PwC, for example, redesigned its office spaces in 2021 with these exact features, along with pink noise and soundproof areas. Such inclusive workspace design allows employees to work in an environment that helps them succeed.

Employee benefits FAQs

How to choose the right employee benefits for your company

To choose the right employee benefits for your company, ask yourself the following:

- What resources, like time and money, do I have for my employee benefits packages?

- What benefits do employees expect in my industry?

- What is the culture and demographics of my staff?

- Where are my employees located?

- What tools do I have to manage my benefits package?

But most importantly, ask your employees: “What benefits do you want?”

Employee engagement software can facilitate surveying employees on your benefits offerings. Culture Amp, for example, offers a U.S.-specific benefits survey to gather insight into the effectiveness of your current benefits and interest in new ones.

Once your benefits packages are in place, most HR software lets employees self-enroll in the benefits they want during onboarding while keeping track of employee and employer contributions. Paycor even provides a benefits advisor feature that improves the employee experience by helping new hires select the benefits that best suit their circumstances.

If you want to learn more, peruse our HR Software and Benefits Administration Software guides for a complete list of software options.