Everyone likes a good showdown. With Alibaba’s recent IPO, people are eager to pit the two eCommerce juggernauts against each other to create an Alibaba vs. Amazon faceoff.

But Alibaba is widely misunderstood. And despite being an enormous eCommerce peer, it’s extremely different from Amazon. Are the two really destined to be arch enemies or is it all just exaggerated drama?

In this post, I’ll be comparing Alibaba vs Amazon and dive deep into the nitty gritty of both companies: what makes them tick, how they make money, how they’re different and what they mean for the future of eCommerce.

Note for Financial Geeks Like Myself: Most of the data below has been taken from Alibaba’s recent IPO prospectus and Amazon’s 2013 annual report. Alibaba’s annual figures represent the calendar year prior to their March 31st fiscal year ends.

History

Most eCommerceFuel readers will be familiar with Amazon’s history. In the mid-90s, Jeff Bezos founded Amazon which began by focusing solely on selling books. They’ve since grown into the behemoth they are today, and are now the largest online retailer in North America.

Alibaba was founded in China by Jack Ma in 1999. Ma didn’t have Bezos’ technology or business background. An English teacher, he had failed at his previous two business ventures. But despite those setbacks, he raised money from family and friends to launch Alibaba.com – a B2B portal for connecting Western businesses and Chinese manufactureres.

Since then, the company has grown to be the largest eCommerce company in the world (measured by both gross sales and company value) and recently went public in the largest IPO in history.

Philosophy

As we’ll get into, there is much that sets these two companies apart. But the starkest contrast can be seen in the philosophy each company has.

Jeff Bezos’ long standing goal is to build the world’s most customer centric company. And it’s hard to argue with his progress. Despite their size, Amazon’s customer service – in terms of pricing, delivery and customer support – is impressive.

Amazon is obsessed with the customer and getting them the best possible price – at almost any cost. They’re notorious for alienating suppliers, content partners and publishers in their pursuit of this goal.

You can see this in their ongoing fights with publishers for higher royalties and by undercutting suppliers by ignoring pricing guidelines as alleged in the book The Everything Store. Even members of the eCommerceFuel Private Forum have reported being squeezed out of a market by Amazon and/or experiencing aggressive tactics.

Jack Ma and Alibaba have a different focus. The following quote is taken from their recent IPO prospectus:

“Our proposition is simple: we want to help small businesses grow by solving their problems through Internet technology. We fight for the little guy. Since our founding in 1999, we have helped millions of small businesses to achieve a brighter future.”

“…we want to help small businesses grow by solving their problems through Internet technology. We fight for the little guy.” -Jack Ma of Alibaba

Alibaba’s goal to help small businesses stands in stark contrast to Amazon, who is often (fairly or otherwise) criticized for making it harder for small businesses to compete and stay relevant online.

So is there ANY common ground between the two? Actually, yes. Both relegate shareholder interests to the bottom of the totem pole.

Jack Ma has repeatedly said that Alibaba’s priorities are their employees, their customers and then the shareholder, in that order. And Jeff Bezos is notorious on Wall Street for continually investing in the future of his company at the expense of providing short term returns / profits to shareholders.

Business Models

Alibaba has traditionally been best known in the United States for Alibaba.com – their B2B portal that connects Chinese factories and businesses. But that’s not why you’ve been hearing so much about them recently. Where they REALLY make their money is in facilitating eCommerce within China.

Alibaba’s Taobao division is where they make the vast majority of their money, is responsible for more than 80% of Alibaba’s sales and consists of two main properties:

The Taobao Marketplace is similar to eBay, and allows consumers and small businesses to list merchandise for sale. The other major platform, Taobao Mall, is more akin to Amazon. It’s a B2C platform that allows larger businesses and brands to sell direct to consumers.

Sales on the Taobao marketplaces make up more than 80% of all online purchases in China. Let me repeat that. 80% of all online purchase in China. That’s mind boggling.

To say they have a stranglehold on eCommerce in China is an understatement. Amazon’s share of the U.S. market is nowhere near those levels.

Alibaba accounts for more than 80% of all online purchases in China.

What’s important to note is that Alibaba’s platforms merely facilitate the transactions. They manage the marketplace and charge a small commission, but don’t hold – or sell – any merchandise themselves.

Amazon, by comparison, plays in both markets. On Amazon.com, you’ll find thousands of products you can by directly from 3rd party businesses. But Amazon is also in the business of stocking items and selling products directly to consumers. In many instances, they’re competing directly with the same merchants who are using their platform to sell.

Both companies have other business arms. Each has a cloud computing division (although Amazon’s is much bigger), both are involved with media creation and Alibaba even owns a stake in a professional Chinese soccer team!

But the marketplaces where they sell products are the bread-and-butter of each one’s business.

Geographic Focus

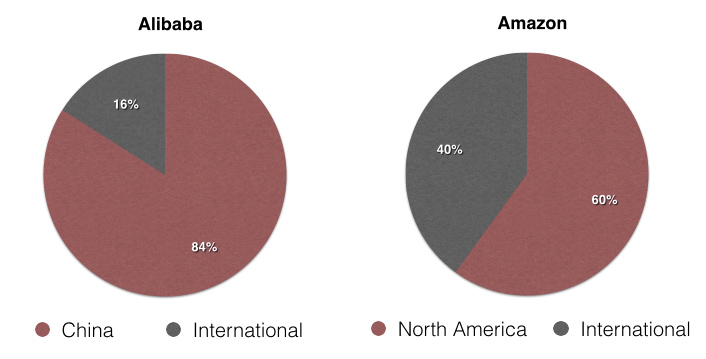

As I’ve mentioned already, Alibaba’s primary money making operations are from operations within China. So the chart below won’t be a surprise.

But what’s interesting is how much of Amazon’s business comes from outside North America – a whopping 40%!

There’s been lots of talk about how Amazon should fear the entrance of Alibaba into the U.S. market – and it will definitely be interesting to see how that plays out. But who has the better track record of expanding outside their home market? It’s definitely Amazon.

Who Sells More Stuff?

In 2013, Alibaba reported GMV (gross merchandise volume) of approximately $250 billion. That means more than $250 billion worth of transactions were made / facilitated via their platforms.

Amazon, by contrast had 2013 product revenues of approximately of $61 billion – significantly less than Alibaba. But this number is misleading, because Amazon doesn’t count any of the sales made by 3rd party merchants in this number. They only count sales where they were the business directly selling to the consumer.

So making the comparison is difficult because the two firms don’t disclose the same metrics (GMV). In a recent article, Ben Evans speculated that Amazon’s actual GMV (the amount of total stuff that gets sold on their site) could be in the range of 2x what they list as product revenue.

So who’s bigger from a product sales standpoint? It’s probably a safe bet to say Alibaba is larger but it’s impossible to know for sure.

Service & Fee Revenues

It’s important to understand that GMV – the value of all the goods sold / orders places on a platform – isn’t the same as what the company actually collects in revenues or profits.

For example, assume someone places a $100 order on one of Alibaba’s sites for a camera. The $100 will count toward the GMV reported, but Alibaba will only receive a tiny fraction of that as a listing / transaction fee – say $2. That tiny fee is ultimately what’s important, because it’s what Alibaba gets to keep as profit.

When you compare the amount of money that Alibaba and Amazon generate (and get to keep) from service fees, a different picture in terms of size emerges.

Despite having a marketplace that moves significantly more goods, Alibaba doesn’t collect nearly as much in fees / sales commission as Amazon.

(Note: There are some fees for other services included in this chart, like cloud based computing offerings, but it’s predominantly made up of fees charged to 3rd party sellers).

Profitability

Alibaba sells more stuff. Amazon generates significantly higher fee revenues. So who ends up actually making more money?

Surprisingly, Alibaba. By a long shot.

In 2013, Alibaba made more than 10x as much money as Amazon. While Alibaba’s profits have grown consistently in the past few years, Amazon’s have languished. Amazon even lost money in 2012.

Why such a massive difference?

Unlike Alibaba, Amazon actually stocks their own products. And building out warehouses in their attempt to take over the eCommerce world is no small (or affordable) feat.

To help normalize this a bit, let’s look to a different metric: free cash flow. Without getting too technical, free cash flow tells you how much cash a company is generating and removes the noise introduced by accounting techniques and other one-time events. In short, it can offer a clearer picture of a business’ health.

Normally, the costs involved with building new warehouses (called capital expenditures) would be taken out of free cash flow. But to normalize our comparison given Amazon’s wild building spree, I’ve added these warehouse expansion costs back in.

Amazon has an ever-so-slight edge, but the two companies both generated approximately $5 billion in free cash flow in 2013.

Why Such a Difference?

As you can see in the chart below, Amazon had a 0.8% profit margin in 2013. Alibaba, by contrast, had a 44% profit margin in 2013 – more than 50x higher.

So what explains this monumental difference? In a phrase, “warehouses vs. software”.

What explains this monumental difference? In a phrase, “warehouses vs. software”.

Alibaba doesn’t sell products themselves. Instead, they simply offer a web platform that facilitates the exchange of good. They’re the world’s largest eCommerce company, but they’re actually much more like a software company than a retailer.

Amazon, by contrast, is in the business of selling directly to consumers – and has to deal with all of the logistically complex and expensive physical aspects that go along with it. Namely, building out a vast warehouse network.

It’s this difference that explains why Alibaba has been able to grow so quickly and remain highly profitable, while Amazon has had to sacrifice profits for two decades to get where they are today.

Bottom line? Software tends to scale better than warehouses do.

The Future

Are these two powerhouses destined to meet in a spectacular pay-per-view battle for eCommerce supremacy? As fun as that would be to watch, it’s unlikely in the near future.

Alibaba has a stranglehold on the Chinese market and Amazon is the undisputed U.S. leader. They both have such a massive head start – and an intimate understanding of their market and models – that it’d be extremely difficult for one to knock the other from their perch.

But Alibaba’s Jack Ma has stated that they have plans to invest seriously in the U.S. And Amazon isn’t known for shying away from a fight, even if it proves to be costly. So what will happen?

There have been talks of Alibaba purchasing a company like eBay or Etsy, which would make sense given their platform approach in China and focus on smaller businesses. But I think a potentially even bigger opportunity for Alibaba would be to help Western merchants reach the massive – and still largely untapped pool – of Chinese consumers.

Imagine if smaller independent U.S. merchants could easily sell and ship their high-end products to consumers in China. Currently, there are a number of issues that make that difficult (logistics, language, culture issues) but Alibaba could create a platform that addressed those problems.

They’ve already proved the model by successfully connecting Chinese manufacturers and western businesses with Alibaba.com. As China’s middle class grows and matures, why not flip that model on its head?

It will be especially interesting to see how Amazon addresses Alibaba’s rise, and what their next move will be.

Given Alibaba’s more profitable and scalable model – and their momentum – I think they have the advantage for any head-to-head battles in new markets. But Amazon does have a better track record of expanding internationally and, like I said earlier, has never been one to shy away from a fight.

Whatever happens, it will undoubtedly be exciting to watch.

What are your thoughts on Alibaba vs Amazon? Leave a comment and let us know what you think.

Related Posts

The Dangers of Selling on Amazon

How to Get Reviews on Amazon

The Top Amazon Seller Mistakes (And How to Avoid Them)