Financial Empowerment: A Dermatologist’s Journey from Paycheck to Prosperity

Meet Dr. Anna Shicone, a board-certified dermatologist nestled in the sun-kissed expanses of Miami, Florida. At 39 years old and with an impressive income approaching $900,000 last year, Dr. Shicone’s financial journey is anything but ordinary. Once struggling with monetary management, her transformation into a savvy saver and investor offers inspiration to many who find themselves wrestling with similar struggles.

The Early Years: Struggles and Realizations

Growing up in Miami—a city often characterized by a vibrant culture, lively beaches, and a palpable intensity of materialistic values—Dr. Shicone began her financial journey just like many. She lived from paycheck to paycheck, well-acquainted with the art of spending, but entirely unfamiliar with saving. “I used to be terrible with money,” she admits, reflecting on her past without shame but with a hint of regret. The lifestyle surrounding her did not encourage prudent financial habits; instead, it gravitated towards consumption and extravagance.

The challenges faced by many medical residents further compounded her financial woes. Though the path to becoming a dermatologist involves years of rigorous education and training, the accompanying salary during residency is often far from generous. As Dr. Shicone navigated her residency, it was difficult to set aside funds for emergencies or future investments. It’s a reality echoed by countless professionals in demanding fields, where long hours and low initial paychecks can overshadow financial education and growth. The intensive schedules often leave little room for understanding complex financial instruments, let alone for strategic planning.

A Wake-Up Call During a Pandemic

A pivotal moment arrived when the COVID-19 pandemic struck, ushering in an era marked by uncertainty and vulnerability. The ripple effects were palpable, reaching even into Dr. Shicone’s personal life with the health complications faced by her father. This situation profoundly influenced her outlook on financial preparedness. She began to realize that without a stable safety net, circumstances could rapidly spiral out of control. “If I didn’t want what happened to my father to happen to me, I had to build a bigger safety net,” she reflects, conveying the urgency with which she approached her finances.

In a world where unpredictability became the norm, the importance of savings became painfully clear. This unfortunate reality led Dr. Shicone to reassess her financial strategies. Her journey emphasizes the need for financial resilience—a topic increasingly relevant in today’s economy, where job security can feel fragile and unexpected financial burdens arise at any moment.

The Turning Point: Seeking Knowledge

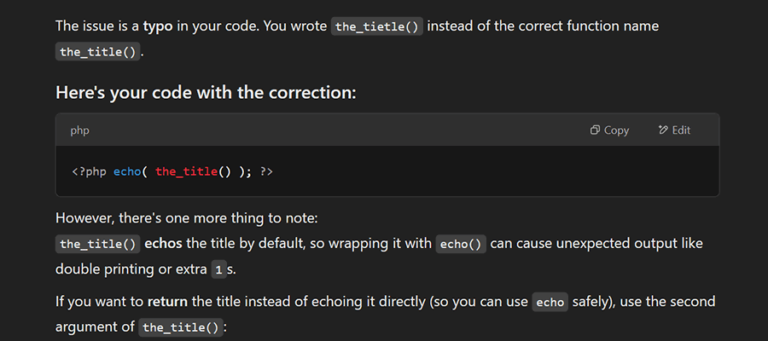

The pursuit of knowledge often serves as a powerful catalyst for change. An article Dr. Shicone discovered in the Wall Street Journal introduced her to Empower and various financial tools. This step marked the launch of her financial transformation. In an age where information is abundant yet overwhelming, this experience serves as a reminder that targeted insights can illuminate pathways to financial security.

Discovering budgeting apps, investment platforms, and retirement accounts became cornerstones of Dr. Shicone’s strategy. She began to educate herself, not only understanding how to save but also how to make smart investments. The perfect blend of professional success and personal empowerment led her on a path toward financial autonomy, granting her the ability to make choices on her own terms.

- Investing Wisely: Understanding the market was crucial. Dr. Shicone researched various options, from stocks to bonds, seeking expert opinions and digging into the nuances of asset allocation.

- Utilizing Retirement Accounts: She discovered the benefits of contributing to retirement accounts such as 401(k)s and IRAs, which provided significant tax advantages while securing her financial future.

Adopting a New Financial Mindset

The most significant transformation in Dr. Shicone’s journey stemmed from adopting a new financial mindset. Gone were the days of living paycheck to paycheck. Today, she thrives as a conscientious planner who prioritizes savings and investments over impulsive spending. Her mindset shift included both tactical changes and emotional growth, moving from fear and anxiety about money to a proactive, educated approach embracing financial literacy.

She describes herself as motivated not just by wealth accumulation but by a desire to care for her family. Financial security, for her, equates to freedom—an ability to navigate life’s opportunities and challenges without the emotional toll of financial stress. “I want to take care of my family,” she emphasizes. This sentiment resonates widely, as many people envision financial stability as a gateway to providing for loved ones and pursuing enriching experiences.

Building Towards the Future

The last five years have seen unprecedented growth in Dr. Shicone’s financial acumen. In discussing her strategy, she highlights the balance of foundational financial health and aspirations. For professionals in high-stakes fields, making informed decisions is imperative, not just for personal benefit but also for family preservation. The growth of wealth is intertwined with planning for the future, be it through insurance, retirement savings, or investing in opportunities that resonate personally.

Real-life examples illustrate this concept vividly. Take the case of physician-turned-entrepreneur Dr. Amanda Pearce, who transformed her medical knowledge into a burgeoning health tech startup. By harnessing her expertise and focusing on financial literacy, she opened new avenues for income while fulfilling her passion. Similarly, Dr. Shicone embodies the principle that financial literacy is a stepping stone to creating a more controlled and secure future.

In reflecting on her journey, Dr. Shicone encapsulates a lesson pertinent for anyone—regardless of their profession or background. Financial literacy is not just a privilege; it is a necessity that empowers individuals to make informed decisions about their lives. As she looks forward, buoyed by newfound insight and resilience cultivated from adversity, Dr. Shicone stands as a beacon of inspiration for those who may currently find themselves at a financial crossroads.

Rather than a mere narrative of her success, Dr. Shicone’s experiences serve as a powerful testament to the significance of learning, adapting, and ultimately thriving in an unpredictable world. The journey from financial despair to stability is a challenging one, but with determination and the right resources, it is undoubtedly achievable.