NVIDIA is moving quickly to expand production of its H200 artificial intelligence processors after a sharp rise in demand from Chinese technology companies, according to Reuters citating people familiar with the matter. The development highlights the growing strain on the global AI chip supply chain as geopolitical, regulatory, and commercial pressures converge.

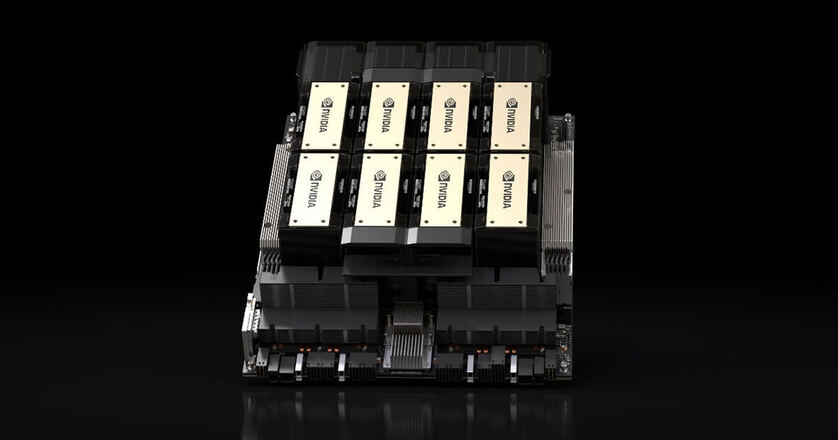

Sources indicate that NVIDIA has approached its key manufacturing partner, Taiwan Semiconductor Manufacturing Company, to place additional orders for the H200, a high-performance processor designed for advanced AI workloads. The talks reportedly involve ramping up production beyond existing commitments, with manufacturing of the additional units expected to begin in the second quarter of 2026.

At present, NVIDIA is estimated to have around 700,000 H200 chips available, while Chinese customers have collectively placed orders exceeding 2 million units for delivery in 2026. The size of the gap underscores the intensity of demand from China’s cloud providers, AI startups, and large technology groups seeking to scale computing capacity for generative AI, data analytics, and large language models.

Approval of Shipments to China

The situation poses a strategic balancing act for NVIDIA. On one hand, China represents a major market eager for advanced AI hardware. On the other, NVIDIA must manage limited manufacturing capacity and strong demand from customers in the United States, Europe, and other regions. Any significant reallocation of supply risks tightening availability elsewhere, potentially driving up prices or extending lead times.

Regulatory uncertainty further complicates the picture. Although exports of the H200 to China were only recently permitted by the US government, Chinese authorities have not yet formally approved incoming shipments. This creates additional risk for NVIDIA, which must commit to production well in advance without full clarity on regulatory timelines.

People familiar with the discussions say NVIDIA has already decided which H200 configurations will be offered to Chinese buyers and is expected to price the chips at roughly $27,000 per unit. Neither NVIDIA nor TSMC has commented on the specifics of the talks, while China’s Ministry of Industry and Information Technology has yet to respond to inquiries.

The episode illustrates how AI hardware has become a focal point of global competition, with supply decisions increasingly shaped by politics as much as by market forces.

Executive Insights FAQ

Why is demand for the H200 rising so sharply in China?

Chinese technology firms are accelerating investments in AI infrastructure to support generative AI, cloud services, and data-intensive applications.

How significant is the supply gap NVIDIA faces?

Current availability reportedly covers less than half of the projected Chinese demand for 2026.

What role does TSMC play in this situation?

TSMC is NVIDIA’s primary contract manufacturer and would be responsible for producing any additional H200 chips.

Could this affect global AI chip availability?

Yes, increased allocation to China could tighten supplies for customers in other regions.

What are the main regulatory risks involved?

Uncertainty around export permissions and Chinese import approvals could delay or disrupt deliveries.