Qvantel has completed its acquisition of Optiva, uniting two established telecom BSS vendors into a larger, AI-focused provider of monetization and digital operations software. The deal, executed through a statutory plan of arrangement under Canada’s Business Corporations Act, reflects accelerating consolidation as operators face pressure to modernize billing, charging, and customer engagement platforms.

The combined organization now serves more than 70 telecom operators and mobile virtual network operators across over 40 countries, supported by a global workforce of more than 1,000 employees operating from 30 locations. Executives from both companies say early market feedback has been encouraging, with four new customer contracts signed within three months of the deal announcement. Among those wins is a multi-country group deployment spanning APAC, the Americas, and Europe, using the Qvantel Flex platform integrated with the Optiva Charging Engine.

Helsinki-based Qvantel has positioned the acquisition as a response to growing demand from operators seeking faster service launches, greater pricing flexibility, and lower operational complexity. Telecom providers are under increasing strain from declining traditional revenues, rising competition from digital-native players, and customer expectations shaped by cloud and streaming services. Against this backdrop, the combined Qvantel–Optiva portfolio aims to deliver a broad, end-to-end monetization stack built around cloud-native architecture, low-code and no-code configuration, and AI-driven automation.

The integration brings together Qvantel Flex, a digital BSS suite designed to give commercial teams direct control over product design and pricing, with Optiva’s real-time charging capabilities. According to the companies, this combination allows operators to adjust offers and processes in hours rather than weeks, reducing time to market and lowering the cost of change. The approach is intended to appeal to both Tier 1 operators managing complex multi-market environments and smaller, fast-growing MVNOs seeking agility without heavy customization.

Qvantel president Tero Kivisaari said the telecom industry has historically been slow to evolve but is now approaching an inflection point, driven by artificial intelligence and rising demand for digital services. He described the combined platform as a future-ready monetization foundation capable of helping operators close the gap between legacy systems and modern customer expectations. Optiva chief executive Robert Stabile echoed that sentiment, pointing to early joint wins and a growing sales pipeline as evidence of market demand for a unified, AI-first approach.

Industry analysts note that consolidation among BSS vendors is likely to continue as operators look for fewer, more capable partners able to support large-scale transformation initiatives. The Qvantel–Optiva deal reflects this trend, emphasizing scale, automation, and software flexibility as key differentiators in an increasingly competitive telecom technology landscape.

Executive Insights FAQ

Why did Qvantel acquire Optiva?

To expand its monetization and digital operations portfolio and address growing operator demand for AI-driven, cloud-native BSS platforms.

What changes for existing customers?

Customers gain access to a broader, integrated product suite with enhanced charging, faster configuration, and improved delivery capabilities.

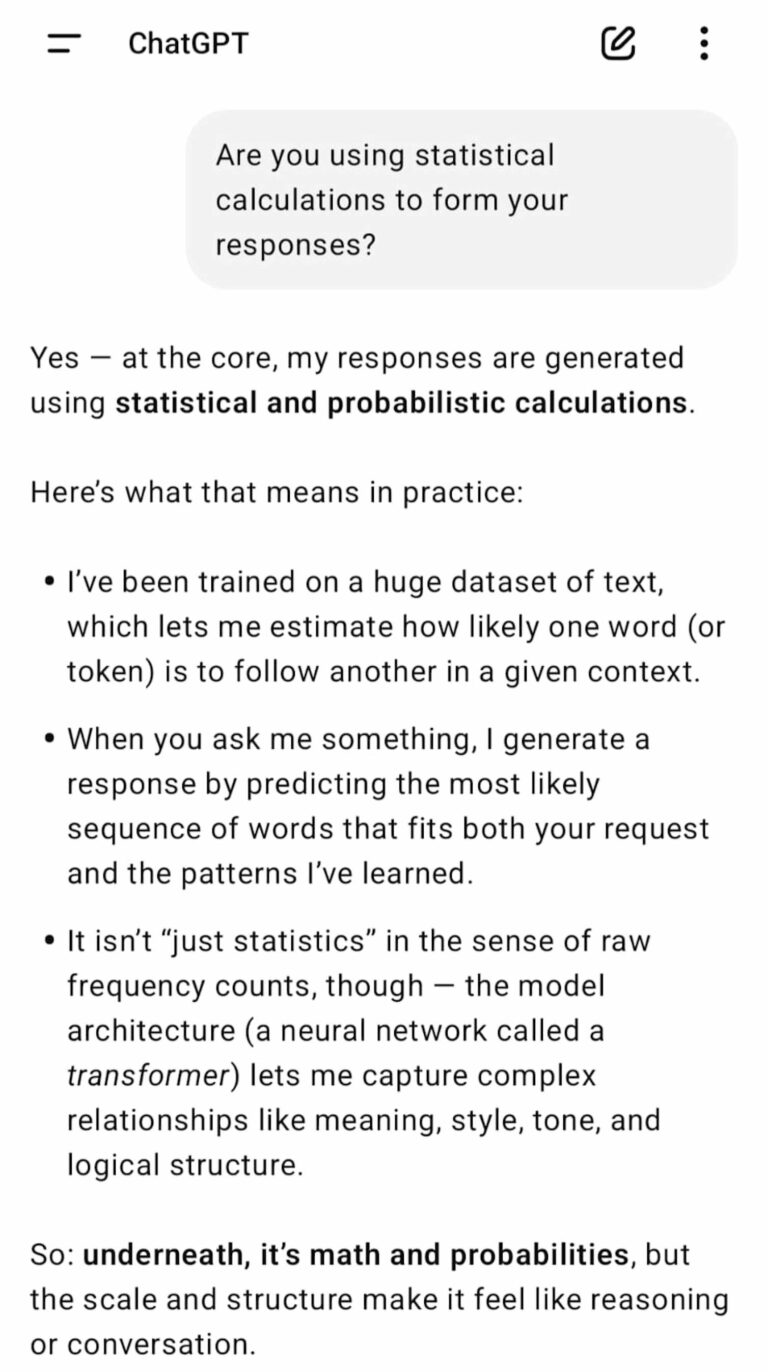

How does AI factor into the combined offering?

AI is used to automate processes, optimize pricing and offers, and reduce operational overhead across monetization workflows.

Which operators benefit most from this merger?

Both Tier 1 telecom operators and agile MVNOs seeking faster service launches and lower cost of change.

What does this signal for the telecom software market?

It highlights continued consolidation and a shift toward unified, AI-first platforms to support digital transformation.